Critics Fear Higher Electricity Rates As New Investors Await Ontario Deregulation

TORONTO -- - Consumers in Ontario could see higher electricity costs in the short term - as Albertans have already seen - after deregulation opens the market to competition, a consumer watchdog group says.

"At this stage we're looking at increases, but it's not clear how big those increases will be or when they will be felt," said Thomas Adams, executive director of Energy Probe, the national environmental and consumer watchdog group. Deregulation of the electricity market in Ontario has been hailed by the provincial government as the best way to ensure competitive hydro prices for consumers.

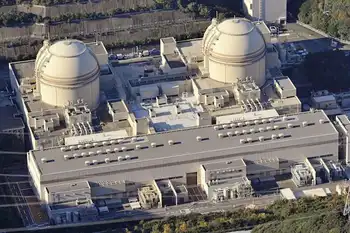

Recently, Ontario Power Generation Inc. signed a $3.1-billion deal to have a private British energy company operate the Bruce nuclear plant on the shores of Lake Huron in southwestern Ontario.

The deal with British Energy PLC is part of a plan to reduce the market dominance of Ontario Power Generation - the former Ontario Hydro - and increase competition and lower rates for consumers.

Adams said policy changes and delays in opening the industry to full deregulation - it was expected to be done in November but is being postponed until next year - may cause some companies to think twice before coming into the market.

Policy shifts have altered the rules of deregulation, causing concern for some investors, he said.

If fewer companies enter the market, it will be less competitive despite being opened up, there will be less supply - and that means prices are more likely to go up, he said.

The uncertainty of the electricity market has caused the Ontario Municipal Employees Retirement Board to put any prospect of further investment in the market on hold until legislation tabled last month is completed, said Jane Courtemanche, manager of corporate communications for OMERS.

In March, the $35-billion pension fund bought a 10 per cent stake in Hydro Mississauga, just west of Toronto, and expressed an interest in acquiring stakes in other municipal utilities.

However, those plans are on hold until there's more certainty in the market, Courtemanche said.

"With all the changes that came about in June, it does have a negative impact on us as an investor," she said. "We're waiting to see what's going to happen" to see if this is the type of investment the pension fund wants to keep pursuing.

TransAlta Corp., a major Alberta power producer, will wait until the Ontario market is fully deregulated before it makes any moves in the province, said Sue Le Breton, TransAlta's manager of corporate communications.

Meanwhile, it's focusing its energies on deregulated markets such as Mexico, Australia and some locations in the U.S.

Ontario Power Generation's deal to lease the Bruce nuclear power station to Edinburgh-based electricity giant British Energy is seen as a big step toward privatization.

Investors watching the industry may be heartened by the fact Ontario has made this deal, said Ian Howcroft, vice-president of the Ontario region for the Alliance of Manufacturers and Exporters Canada, whose members buy huge amounts of electricity to run their businesses.

"We've been waiting for a while. We've seen the opening of the market delayed and there's been a lot of concern," Howcroft said. "This is good because it pushes the agenda forward and is also going to inspire some confidence and show that there is some direction finally."

There are no guarantees that competition will bring lower electricity prices to the province, but a competitive market is the best option, Howcroft said.

In Alberta, where power industry deregulation is under way, consumers saw electricity shortages, higher costs and brownouts last year as demand outpaced expansion.

June's hydro rate in the province hit the highest level since Alberta began deregulating the industry four years ago.

While explosive economic growth in Alberta contributed to the level of demand for electricity and the subsequent rate increases, Adams said policy shifts and uncertainty of the rules in the market delayed the arrival of some investors.

The service problems Alberta had - shortages and brownouts - could happen in Ontario if investors decide they don't want to put out significant resources due to uncertainty in the market, Adams said.

"That's a situation we could find ourselves in here in Ontario," he said. "The recent behaviour of the Ontario energy minister makes me very concerned that that's exactly where we're headed."

Other than postponing the opening of the market, the government also tabled legislation that would restrict the efforts of municipal utility companies to raise distribution rates, a factor that investors included in their business decisions.

That restriction didn't break policy because Energy Minister Jim Wilson had told the industry he would protect energy consumers from unreasonable price increases even if he had to use legislation to do so, said Michael Krizanc, a spokesman for the minister.

"The whole idea of electricity competition is to provide the lowest possible rates to electricity consumers," Krizanc said.

Krizanc said there's been $3 billion worth of new investment announced in Ontario's hydro industry, which shows investors want to be part of this market.

Related News

Trump's Order Boosts U.S. Uranium and Nuclear Energy

WASHINGTON DC - In a strategic move to bolster the United States' nuclear energy sector, former President Donald Trump issued an executive order on January 20, 2025, directing the Secretary of the Interior to instruct the U.S. Geological Survey (USGS) to reconsider classifying uranium as a critical mineral. This directive aims to enhance federal support and streamline permitting processes for domestic uranium projects, thereby strengthening national energy security.

Reclassification of Uranium as a Critical Mineral

The USGS had previously removed uranium from its critical minerals list in 2022, categorizing it as a "fuel mineral" that did not qualify for such…