Clean Energy Industry Support includes tax credits, refundability, safe harbor extensions, EV incentives, and stimulus measures to stabilize renewable energy projects, protect the workforce, and ensure financing continuity during economic recovery.

Key Points

Policies and funding to stabilize renewables, protect jobs, and extend tax incentives for workforce continuity.

✅ Extend PTC/ITC and remove phase-outs to sustain projects

✅ Enable direct pay or refundability to unlock financing

✅ Preserve safe harbor timelines disrupted by supply chains

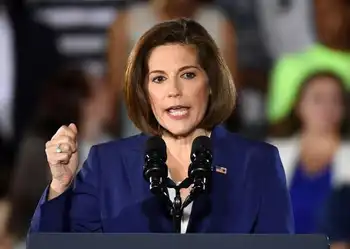

U.S. Senator Catherine Cortez Masto (D-Nev.) led 17 Senate colleagues, as the Senate moves to modernize public-land renewables, in sending a letter calling on Congress to include support for the United States' clean energy industry and workforce in any economic aid packages.

"As Congress takes steps to ensure that our nation's workforce is prepared to emerge stronger from the coronavirus health and economic crisis, we must act to shore up clean energy businesses and workers who are uniquely impacted by the crisis, echoing a power-sector call for action from industry groups," said the senators. "This action, which has precedent in prior financial recovery efforts, could take several forms, including tax credit extensions or removal of the current phase-out schedule, direct payment or refundability, or extensions of safe harbor continuity."

"We need to make sure that any package protects workers and helps families stay afloat in these challenging times. Providing support to the clean energy industry will give much-needed certainty and confidence, as the sector targets a market majority, for those workers that they will be able to keep their paychecks and their jobs in this critical industry," the senators also said.

In addition to Senator Cortez Masto, the letter was also signed by Senators Ed Markey (D-Mass.), Martin Heinrich (D-N.M), Sheldon Whitehouse (D-R.I.), Debbie Stabenow (D-Mich.), Tina Smith (D-Minn.), Jack Reed (D-R.I.), Cory Booker (D-N.J.), Richard Blumenthal (D-Conn.), Amy Klobuchar (D-Minn.), Chris Van Hollen (D-Md.), Dianne Feinstein (D-Calif.), Jacky Rosen (D-Nev.), Tammy Duckworth (D-Ill.), Chris Coons (D-Del.), Mazie Hirono (D-Hawaii), Dick Durbin (D-Ill.), and Kyrsten Sinema (D-Ariz.).

Dear Leader McConnell, Leader Schumer, Chairman Grassley, Ranking Member Wyden:

As Congress takes steps to ensure that our nation's workforce is prepared to emerge stronger from the coronavirus health and economic crisis, we must act to shore up clean energy businesses and workers who are uniquely impacted by the crisis, with wind investments at risk amid the pandemic. This action, which has precedent in prior financial recovery efforts, could take several forms, including tax credit extensions or removal of the current phase-out schedule, direct payment or refundability, or extensions of safe harbor continuity.

First and foremost, we need to take care of workers' health and immediate needs to stay in their homes and provide for their families, and the Families First Coronavirus Response Act is a critical down payment. Now, we must make sure the workforce has jobs to return to and that employers remain able to pay for critical benefits like paid sick and family leave, healthcare, and Unemployment Insurance.

The renewable energy industry employs over 800,000 people across every state in the United States. This industry and its workers could suffer significant harms as a result of the coronavirus emergency and resulting financial impact. Renewable energy businesses are already seeing project cancellations or delays, as the Covid-19 crisis hits solar and wind across the sector, with the solar industry reporting delays of 30 percent. Likewise, the energy efficiency sector is susceptible to similar impacts. As the coronavirus pandemic intensifies in the United States, that rate of delay or cancellations will only continue to skyrocket. Global and domestic supply chains are already facing chaotic changes, with equipment delays of three to four months for parts of the industry. A major collapse in financing is all but certain as investment firms' profits turn to losses and capital is suddenly unavailable for large labor-intensive investments.

To ensure that we do not lose years of progress on clean energy and the source of employment for tens of thousands of renewable energy workers, Congress should look to previous relief packages as an example for how to support this sector and the broader American economy. The American Recovery and Reinvestment Act of 2009 (also known as the Recovery Act or ARRA) provided over $90 billion in funding for clean energy and grid modernization, along with emergency relief programs. Specifically, ARRA provided immediate funding streams like the 1603 Cash Grant program for renewables and the 30 percent clean energy manufacturing tax credit to give immediate relief for the clean energy industry. As Congress develops this new package, it should consider these immediate relief programs for the renewable and clean energy industry, especially as analyses suggest green energy could drive Covid-19 recovery at scale. This could include direct payment or refundability, extensions of safe harbor continuity, tax credit extensions, electric vehicle credit expansion, or removal of the current phase-out schedules for the clean energy industry.

We need to make sure that any package protects workers and helps families stay afloat in these challenging times. Providing support to the clean energy industry will give much-needed certainty and confidence for those workers that they will be able to keep their paychecks and their jobs in this critical industry.

These strategies to provide assistance to the clean energy industry must be included in any financial recovery discussions, particularly if the Trump Administration continues its push to aid the oil industry, even as some advocate a total fossil fuel lockdown to accelerate climate action. We appreciate your consideration and collaboration as we do everything in our power to quickly recover from this health and economic emergency.

Related News