Agreeing to unplug to reduce demand

By New York Times

CSA Z463 Electrical Maintenance -

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

Peak load is the single hour of highest use in the course of the year, a condition for which the electric system is designed and which is the focus of utilitiesÂ’ operating strategies and, sometimes, prayers. Driven by each new air-conditioner, computer and flat-screen television, peak load grew inexorably from the 1980s until the recession.

But it has stopped its climb, and experts say more is at work here than the stalled economy.

Electricity experts compare July 2010 to August 2006, when New York State set its all-time peak demand, 33,939 megawatts. Energy consumption last month was 7.8 percent higher than in August 2006. But the peak demand was 1.4 percent lower.

Last summer was relatively cool and did not yield high numbers for energy consumption or peak demand.

There are several small reasons that consumption grows while peak load does not. One is weather patterns, the ratio of very hot days, which drive consumption, to extremely hot days, which drive peak. But another is man-made: “demand-side management,” under which customers agree to unplug when controllers need them to.

When balancing electricity supply with demand, demand-side management is a huge weight on the scale on critically hot days.

From the fountain at Lincoln Center to the laundry room and swimming pool at the Gotham condominium building on East 87th Street to the elevators and loading dock lighting at 344 Hudson Street in Manhattan, things are being turned off when supply demands it.

The system controllers in Albany, at the New York Independent System Operator, now count about 37,400 megawatts of generators statewide that can be turned on, and about 2,200 megawatts of consuming devices that can be turned off.

This is not an emergency procedure or an appeal to civic duty — although those can still be invoked on occasion. Rather, it is a commercial transaction with a protocol planned long in advance. On the afternoon before an anticipated surge in demand, e-mails, faxes and phone calls go out alerting those who had already agreed that it is time for them to unplug.

“You get called a day ahead, and all hell breaks loose when they call,” said Leo Cutone of Cutone & Company Consultants, which recruits buildings and institutions to participate. Common steps are adjusting air-conditioning thermostats, turning off some elevators, switching off lobby lights or starting up emergency generators.

“If it’s nice and sunny enough, then the lobby is bright enough without artificial lighting,” said Lewis Kwit of Energy Investment Systems, a company that serves as a “demand response service provider.”

Mr. Kwit has lined up about 10 apartment buildings where superintendents will close the laundry room and post signs asking tenants to delay using their dishwashers until the early morning. “You can save 20 to 30 percent,” he said.

Companies that recruit buildings or property owners to participate are paid by the New York Independent System Operator or by the local utility. The prices have been running $12 to $13 per kilowatt of reduction.

Alfonse Amore, the senior vice president at Trinity Real Estate, a property management company, said it enrolled 13 office buildings in the program this summer. Building personnel go from door to door asking tenants to turn off nonessential equipment.

“Tenants are fully aware of the problems with electrical distribution,” he said. “They want to continue in business without having a blackout or a brownout.” And they understand immediately when walking through a slightly darkened lobby, he said.

TrinityÂ’s buildings have a collective load of 16 megawatts and can cut that by 2 megawatts, said Alec V. Salticov, the manager of engineering. Next summer, he will try for 3.5 megawatts, he said. The procedure was invoked by the grid operators three times in July, Mr. Salticov said.

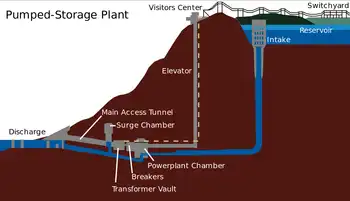

Participants have meters with modems or other communications devices that report to a local utility four times an hour. For energy companies, demand-side management may help them avoid building power plants that would be needed only a few hours a year or transmission and distribution lines that would seldom be used to capacity. Trimming the peak load by a few percentage points means getting more use out of existing equipment.

In a place like New York, where getting permission to build a plant or power line is extremely difficult, energy experts say the strategy is especially valuable. And its effects are obvious at Consolidated Edison, said Joseph Oates, vice president of energy management.

Con Ed’s peak load growth had been 1.5 percent a year but will probably be only about 0.35 percent for the next few years, despite the proliferation of cheap air-conditioners and big-screen televisions. “We think it’s a permanent change,” he said.

Apart from the proceeds flowing to the demand response service providers and customers, the technique may also ultimately cut costs for nonparticipants. Electricity is priced in an auction system, and reducing demand reduces the price.