FPL, Constellation in advanced merger talks

NEW YORK, NEW YORK - FPL Group Inc., parent of the Florida Power and Light utility, is in advanced talks to acquire Constellation Energy Group Inc. for more than $11 billion, sources familiar with the situation said recently.

The deal would create a top-tier nuclear generator, as well as adding strength to Constellation's unregulated generation business and helping to diversify FPL away from its reliance on Florida, analysts said.

The boards are expected to vote December 17 and if approved, the deal could be announced as early as the following Monday, the sources said. The talks were fluid, though, the sources said, and as with any deal could break down before a final agreement materializes.

Shares in Constellation surged more than 9 percent in afternoon trading on news of the talks. FPL shares also rose.

Early reaction was positive, with Deutsche Bank saying that the deal was more about strategy than cost-cutting and efficiencies, as well as expanding FPL's footprint in nuclear generation.

"In principle, we would not view a combination between the two companies as a bad thing," analyst Robert Rubin said in a research note.

"Our initial reaction is that we are intrigued by how this merger is going to be positioned and structured; in principle we think it could work as the deal is not simply two companies combining for a lack of something else to do," Rubin said.

Officials from the two companies were not immediately available for comment.

If the companies agree to merge, it would be the first major deal between power companies with substantial regulated operations since Congress repealed a 70-year-old law that restricted utility mergers this summer.

Lehman Brothers said the deal could add 5 percent to the combined company's earnings in 2007 after cost cuts and other merger savings.

"We don't see significant hurdles to closing and foresee a 12-15 month approvals process," analyst Daniel Ford said in a research note.

Constellation shares were up $5.09 at $61.36 on the New York Stock Exchange. FPL shares were up 16 cents, less than 1 percent, at $43.03.

An FPL-Constellation merger would create a top-tier U.S. power company with operations all along the U.S. East Coast and more than 30,000 megawatts of power generation.

A deal would also give FPL access to Constellation's merchant energy operations, which sell power at competitive rates, and accounted for more than 80 percent of the company's earnings in 2004. Constellation is also the parent of the Baltimore Gas & Electric utility.

The deal would be the latest in a string of multibillion-dollar acquisitions in the U.S. utility industry over the last year.

Power companies have been consolidating after years of shedding assets, slashing debt and refocusing on their core operations in the wake of Enron's 2001 bankruptcy and the subsequent collapse of the energy trading market.

Duke Energy Corp. in May announced the $9 billion acquisition of Cinergy Corp., and Warren Buffett's Berkshire Hathaway Inc. agreed in May to buy the PacifiCorp utility from Britain's Scottish Power Plc for $5.1 billion.

In December 2004, Exelon Corp. agreed to pay $13.2 billion for New Jersey's Public Service Enterprise Group Inc.

FPL's Florida Power and Light unit provides electricity to more than 4.2 million residential and business customers in Florida. The company also has a wholesale energy unit that was responsible for about a quarter of its 2004 earnings.

Related News

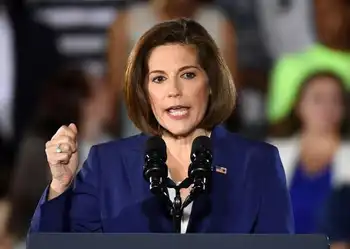

Sen. Cortez Masto Leads Colleagues in Urging Congress to Support Clean Energy Industry in Economic Relief Packages

WASHINGTON - U.S. Senator Catherine Cortez Masto (D-Nev.) led 17 Senate colleagues in sending a letter calling on Congress to include support for the United States' clean energy industry and workforce in any economic aid packages.

"As Congress takes steps to ensure that our nation's workforce is prepared to emerge stronger from the coronavirus health and economic crisis, we must act to shore up clean energy businesses and workers who are uniquely impacted by the crisis," said the senators. "This action, which has precedent in prior financial recovery efforts, could take several forms, including tax credit extensions or removal of the…