Manitoba Hydro To Study Wind Farms

WINNIPEG -- - Manitoba Hydro has finalized a 320-thousand-dollar contract with a Quebec company to research possible sites for wind farms in the province.

Hydro president Bob Brennan says the contract, with Helimax Energie, is for a year-long study that will see 60-metre-high towers equipped with wind testing equipment erected on the sites.

He says if the study determines there is enough wind at one or more of the seven locations, the initial plan will be to build one or two wind farms.

In addition to wind speed, the locations are scouted for proximity to existing hydro grids to reduce the cost of building new power lines.

To be effective, wind turbines can only be erected in a region with average wind speeds over 22 kilometres an hour.

Related News

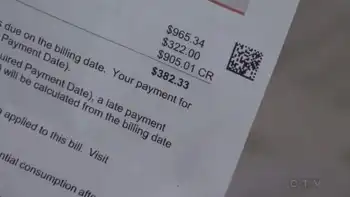

Ontario’s Electricity Future: Balancing Demand and Emissions

TORONTO - Ontario Electricity Transition faces surging demand, GHG targets, and federal regulations, balancing natural gas, renewables, battery storage, and grid reliability while pursuing net-zero by 2035 and cost-effective decarbonization for industry, EVs, and growing populations.

Key Points

Ontario Electricity Transition is the province's shift to a reliable, low-GHG grid via renewables, storage, and policy.

✅ Demand up 75% by 2050; procurement adds 4,000 MW capacity.

✅ Gas use rises to 25% by 2030, challenging GHG goals.

✅ Tripling wind and solar with storage can cut costs and emissions.

Ontario's electricity sector stands at a pivotal crossroads.…