Resourcehouse inks coal deal with China Power

However, China Power denied media reports on the contract and claimed that it had only signed an agreement of intent with Resourcehouse and that the two firms had not yet embarked on price negotiations. An unnamed official from China Power was quoted as suggesting that the value of the deal, projected at $60 billion, was only an estimation revealed by Resourcehouse ahead of its listing on the Hong Kong stock exchange later this year.

According to reports, coal will be procured from a thermal coal mine named "China First," proposed to be developed in the Galilee Basin of Queensland with an investment of $8 billion. The mine is estimated to contain more than 1 billion tons of coal reserves.

The Export-Import Bank of China has agreed to contribute $5.6 billion through debt financing. The balance funds for the project would be contributed by Clive Palmer, an Australian billionaire and the chairman of Resourcehouse.

Palmer expects to break ground on the project in the second half of this year. The project will include development of four underground and two surface mines, in addition to associated handling and processing facilities. It will be linked to a new coal terminal on the coast of Queensland at Abbot Point through a 495 kilometer railway line. The coal mine is scheduled to produce about 40 million tons per year of coal, starting in 2014.

Resourcehouse awarded an engineering, procurement and construction (EPC) contract worth $8.01 billion to engineering and construction firm Metallurgical Corporation of China Limited (MCC), which will manage a syndicated group comprising Sino Coal International Engineering Group, China Railway Group Limited, and China Communications Construction Company Limited to develop the project.

Development of the mine and associated infrastructure is expected to create 6,000 employment opportunities during construction and 1,500 jobs during operations. According to Queensland premier Anna Bligh, the project is expected to generate annual royalties of more than $605 million for the state government from 2014.

According to Palmer, Resourcehouse's contract with China Power is the largest export deal in Australian history. The EPC contract awarded to MCC is also reported to be the largest in Queensland. MCC also has agreed to acquire a 10% stake in the China First project, as well as a 5% equity stake in Resourcehouse through the purchase of shares worth $200 million. The transaction is subject to approval from the Australian and Chinese governments as well as the shareholders of Resourcehouse.

Through its listing, Resourcehouse plans to raise up to $3 billion in funds to invest in coal, oil and gas, and iron ore projects in Australia and in oil and gas exploration activities in Papua New Guinea. MCC also will receive a commission of 4% from the sale of 30 million tons per year of coal to China Power.

Resourcehouse's contract with China Power is being touted as a historic deal that would further strengthen trade ties between China and Australia, which is already the largest supplier of coal to China. Australia accounted for 43.9 million tons of China's total imports of 125.8 million tons of coal last year. China, on the other hand, was the third largest investor in Australia in 2008, behind only the U.S. and Britain. Asian investors accounted for 153 deals in Australia, of which China alone was involved in 49 transactions, spending $6.78 billion primarily in mining acquisitions.

It was only last year that China, the world's largest producer and consumer of coal, first became a net importer of coal. Coal imports by the Asian giant more than tripled last year, following aggressive recovery in demand and a severe winter. Coal accounts for nearly 70% of the country's primary energy consumption, and demand is set to increase further as China anticipates an economic growth rate of 8% and an increase of 7% in power consumption this year.

The deal with Resourcehouse is expected to enhance the energy security of China, which imports coal mainly from Southeast Asian nations such as Indonesia and Vietnam. However, in view of China Power's denial of media reports on the contract, it remains to be seen how the transaction will pan out.

Related News

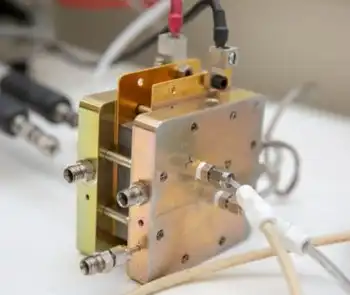

New fuel cell concept brings biological design to better electricity generation

MADISON - Fuel cells have long been viewed as a promising power source. But most fuel cells are too expensive, inefficient, or both. In a new approach, inspired by biology, a team has designed a fuel cell using cheaper materials and an organic compound that shuttles electrons and protons.

Fuel cells have long been viewed as a promising power source. These devices, invented in the 1830s, generate electricity directly from chemicals, such as hydrogen and oxygen, and produce only water vapor as emissions. But most fuel cells are too expensive, inefficient, or both.

In a new approach, inspired by biology and published…