Minnesota Signs Deal With Manitoba Hydro

WINNIPEG -- - The Minnesota Public Utilities Commission has unanimously approved a $1.7 billion power export deal with Manitoba Hydro.

It allows Minneapolis-based Xcel Energy to import power from Manitoba Hydro, despite the objections of aboriginal groups.

The 500-megawatt, 10-year deal was given the go-ahead.

It's an extension of an existing deal and will allow power to be exported until 2015.

Approval by Canada's National Energy Board is pending.

The Minnesota decision is a blow to the Pimicikamak Cree Nation of Cross Lake, Manitoba. They had asked the commission to first call a formal hearing into the social and economic impact of historic hydro development on their homeland.

Related News

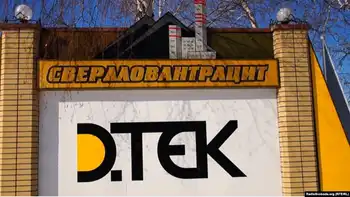

More Managers Charged For Price Fixing At Ukraine Power Producer

KIEV - DTEK Rotterdam+ price-fixing case scrutinizes alleged collusion over coal-based electricity tariffs in Ukraine, with NABU probing NERC regulators, market manipulation, consumer overpayment, and wholesale pricing tied to imported coal benchmarks.

Key Points

NABU probes alleged DTEK-NERC collusion to inflate coal power tariffs via Rotterdam+; all suspects deny wrongdoing.

✅ NABU alleges tariff manipulation tied to coal import benchmarks.

✅ Four DTEK execs and four NERC officials reportedly charged.

✅ Probe centers on 2016-2017 overpayments; defendants contest.

Two more executives of DTEK, Ukraine’s largest private power and coal producer and recently in energy talks…