Minnesota Signs Deal With Manitoba Hydro

WINNIPEG -- - The Minnesota Public Utilities Commission has unanimously approved a $1.7 billion power export deal with Manitoba Hydro.

It allows Minneapolis-based Xcel Energy to import power from Manitoba Hydro, despite the objections of aboriginal groups.

The 500-megawatt, 10-year deal was given the go-ahead.

It's an extension of an existing deal and will allow power to be exported until 2015.

Approval by Canada's National Energy Board is pending.

The Minnesota decision is a blow to the Pimicikamak Cree Nation of Cross Lake, Manitoba. They had asked the commission to first call a formal hearing into the social and economic impact of historic hydro development on their homeland.

Related News

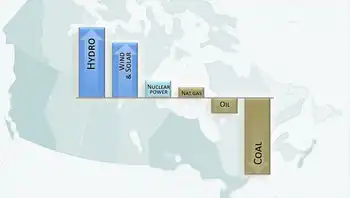

Canada's nationwide climate success — electricity

OTTAWA - Canada Clean Electricity leads decarbonization, slashing power-sector emissions through coal phase-out, renewables like hydro, wind, and solar, and nuclear. Provinces cut carbon intensity, enabling electrification of transport and buildings toward net-zero goals.

Key Points

Canada Clean Electricity is the shift to low-emission power by phasing out coal and scaling renewables and nuclear.

✅ 38% cut in electricity emissions since 2005; 84% fossil-free power.

✅ Provinces lead coal phase-out; carbon intensity plummets.

✅ Enables EVs, heat pumps, and building electrification.

It's our country’s one big climate success so far.

"All across Canada, electricity generation has been getting much…