Gas and Hydro In Turmoil

WINDSOR -- - It was a tumultuous year in the retail energy sector.

Homeowners, businesses and industry reeled from unprecedented electricity price increases in Ontario's failed attempt at deregulation.

And natural gas customers got socked by a government-approved retroactive rate increase.

The parallel events sent people reeling as they opened their bills to find soaring charges that many customers simply could not afford.

A massive public outcry led by opposition MPPs resulted in an embarrassing retreat by the Conservative government from the controversial electricity program.

Similar complaints resulted in Union Gas delaying -- but not forgoing -- its retroactive increase approved by the Ontario Energy Board.

The electricity fiasco also caused headaches for municipal utilities such as EnWin of Windsor, which had to spend millions to revamp its computerized billing procedures to handle the complex deregulation market, only to go back to square one after six months.

Before May 1, electricity was regulated at 4.3 cents per kilowatt hour, but after that date the market opened under a complicated scheme that saw prices vary by the minute.

Local utilities, scrambling to come up with a way to charge a reasonable rate based on prices but overwhelmed by the complexity of it all, handled billing in different ways.

In Windsor, for example, EnWin hired new staff, developed new billing software and increased meter reading frequency from every two months to monthly.

It averaged the price over a month and charged that rate, based on actual electricity use. Consumers were not able to save money by using power during off-peak times when the prices dropped, because the rate charged was based on the average.

An unusually hot summer resulted in unprecedented power demand throughout Ontario, driving up prices and bills by up to 100 per cent at times.

Rates began to fall in the autumn, but the damage was done. As people opened their bills the howls of outrage became deafening.

Premier Ernie Eves abruptly cancelled deregulation by freezing rates at 4.3 cents per kw/h until 2006 and agreeing to reimburse customers the difference since May 1.

But he didn't save Union Gas customers. The utility last year applied for a retroactive rate hike because of higher gas costs in the winter of 2000, which affected its operating costs. It sought and received energy board approval to charge each residential customer an extra $120 -- spread over six months.

Opposition MPPs, including Dwight Duncan of Windsor-St. Clair protested, but the energy board decision was not cancelled.

To soften the blow, Union Gas agreed to start charging the retroactive increase in January, after the Christmas season and to "work with" customers who had trouble meeting the payments.

Related News

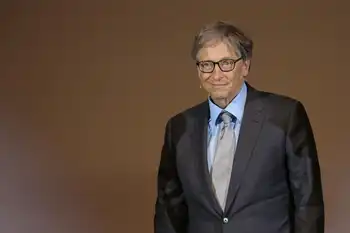

Bill Gates’ Nuclear Startup Unveils Mini-Reactor Design Including Molten Salt Energy Storage

SAN FRANCISCO - Natrium small modular reactor pairs a sodium-cooled fast reactor with molten salt storage to deliver load-following, dispatchable nuclear power, enhancing grid flexibility and peaking capacity as TerraPower and GE Hitachi pursue factory-built, affordable deployment.

Key Points

A TerraPower-GE Hitachi SMR joining a sodium-cooled reactor with molten salt storage for flexible, dispatchable power.

✅ 345 MW base; 500 MW for 5.5 hours via thermal storage

✅ Sodium-cooled coolant and molten salt storage enable load-following

✅ Backed by major utilities; factory-built modules aim lower costs

Nuclear power is the Immovable Object of generation sources. It can take…