Hydro Market Not as Ontario Planned

TORONTO -- - It was to be the largest privatization in Canadian history and a mammoth exercise in deregulation.

But a year later former Ontario premier Mike Harris's boast that opening the province's $10-billion electricity market to competition would mean stable prices has proven hollow and provided fuel to critics of the Conservative government.

In the end, Premier Ernie Eves was forced to beat one of the more remarkable retreats in recent legislative times as he faced a consumer revolt against skyrocketing power prices.

Henry Jacek, a political science professor at McMaster University in Hamilton, said the Conservative government may have taken on more than it could handle when it unleashed what the New Democrats have dubbed the deregulation monster.

"This was a large, complicated technical system, a lot more technical and complicated than the ideology of the people in (Harris's) office understood," said Jacek.

Most were taken by surprise when Harris announced in the dying days of his tenure last December that the province's publicly owned transmission grid would be sold. It was a court ruling in April on a challenge initiated by two unions that the province had no authority to do so that jolted the government.

The ruling focused attention on the hydro debate and gave credibility to critics of the government's plans.

Sensing a smoldering shift in the public mood, Eves backtracked on the privatization of Hydro One, the province's giant transmission utility.

Plans for what would have been the largest initial public share offering in the country's history were put on hold pending further consultations.

The hastily arranged consultations got off to a rocky start when Chris Stockwell, who held the dual portfolios of environment and energy, bolted from a hearing room in London, Ont., after being heckled.

In the middle of what was becoming an increasingly volatile situation, the electricity generation market opened quietly to competition on May 1.

Jacek said the government created "a great deal of disequilibrium" with the changes.

"They took a system that had essentially worked relatively well for 50, 75 years and then started making changes without really appreciating how it would set in train a set of events that would be very, very unpopular," said Jacek.

Harris had announced the opening of electricity generation to competition following two years of hedging caused by disastrous experiences in California and Alberta.

Predictions of a recurrence seemed premature as electricity prices fell in the first two months below the pre-May 1 level of 4.3 cents per kilowatt hour. There would be no massive price spikes, no brownouts or blackouts. No California.

But when Eves finally set the plan in motion, the hydro file grew hot as a scandal erupted over the compensation paid to Hydro One's senior executive officers.

Word that Eleanor Clitheroe had earned $2.2 million, including $174,000 for a car allowance and another $170,000 for vacation pay, and had negotiated a $6-million exit package sparked outrage.

Thrown on the defensive, Eves ordered Clitheroe's pay be cut and introduced legislation to fire the board of directors that had approved her compensation.

The directors resigned en masse, paving the way for Glen Wright to be named as Clitheroe's replacement.

Clitheroe said nothing publicly until Wright called an extraordinary news conference to announce he was firing her for her free-spending ways.

Her response was to launch a lawsuit, which is still before the courts.

In the interim, the government pushed through the legislature a law giving it the power to sell Hydro One, although it later insisted it planned to sell off only 49 per cent of the grid.

As temperatures cooled over the compensation issue, the spring gave way to one of the hottest summers in almost 50 years.

Ontario scrambled for power as air conditioners across the province helped suck up record amounts of juice. The province teetered on the edge of brownouts, prompting imports of exorbitantly priced power from the US and elsewhere.

What wasn't widely known were the problems associated with the two generators that kept key sources of power off the grid, sowing yet another minefield for the government.

At the Pickering power plant, just east of Toronto, no one who reports to the government appears to have realized a project to refurbish four main reactors had gone off the rails - with cost overruns heading toward $2 billion - and still no sign of power from them.

The weather stayed hot. Power prices kept rising. Bills for amounts much higher amounts than usual began arriving for millions of consumers and businesses.

For weeks, the opposition used the daily question period to cite tales of hardship caused by electricity bills that in some cases had doubled.

Public discontent over the bills grew as Tory backbenchers began to openly express their unhappiness, in some cases circulating petitions. A cabinet minister voiced his concerns.

Then on Remembrance Day, Eves capitulated.

Sid Noel, a political-science professor at the University of Western Ontario, said the government understands how perilous the electricity situation is.

"The hot-button potential of hydro is something the Tories are, naturally, very afraid of because they have been very adept at using hot-buttons themselves in their previous campaigns."

Eves announced a price freeze on retail electricity prices until 2006. Consumers would pay no more than the 4.3 cents per kilowatt hour they had paid prior to his opening of the market.

Furthermore, consumers would be rebated for power they bought at prices above that rate.

Wholesale prices would be allowed to continue to fluctuate.

An analysis by Aegent Advisors of Toronto projected the total cost of the Eves' plan at $1.8 billion, although the premier insisted the measures would be paid for from a fund collected by Ontario Power Generation.

Winter temperatures and long nights have already combined to push power consumption and prices to near-peak levels, again raising the spectre of shortages and massive price spikes.

To deal with the supply shortages, the government is counting on new tax incentives and a calmer market to lure generation investment into the province.

Part of the long-delayed refurbishment of the Pickering nuclear reactor should also finally add desperately needed megawatts to the grid next spring and bring wholesale prices down.

And with rebates arriving over the next several months, Eves might consider the hydro storm calmed enough to go to the polls - before another long, hot summer strikes again.

Key developments in the deregulation and privatization of Ontario's electricity market in the past year:

2001

Dec. 12: Premier Mike Harris announces plans to sell the province's electricity grid and open the $10-billion electricity market to competition as of May 1, 2002.

2002

Feb. 12: Leadership candidate Elizabeth Witmer is mocked by fellow Tories during leadership debate when she expresses doubts about hydro deregulation.

April 15: Ernie Eves sworn in as premier.

April 19: Court rules province has no legal authority to sell off its electricity grid, Hydro One.

April 30: Energy Minister Chris Stockwell bolts from public hearings on privatization of Hydro One amid heckling.

May 1: Electricity generation market opens to competition.

May-June: Prices fall below pre- open-market price of 4.3 cents per kilowatt hour.

May 29: Government introduces legislation to skirt court ruling so it can sell Hydro One.

June 12: Eves kills plan to sell Hydro One, says province will maintain majority share in company.

June 27: Government passes laws to sell Hydro One and fire board of the transmission utility.

July-Sept: Demand for power reaches record levels amid unusually hot weather. Bills shoot up.

July 3: Stockwell pleads with public to conserve power.

July 19: Hydro One CEO Eleanor Clitheroe fired for cause over out-of-control spending.

Aug. 15: Government announces new board of directors for Hydro One.

Aug. 22: Eves splits energy and environment portfolio. John Baird takes over as energy minister.

Sept. 9: Market supply regulator implements three per cent voltage cut lasting 20 minutes.

October: Opposition begins almost daily attacks on Eves government over personal hardship caused by high prices.

Oct. 7: Independent Electricity Market Operator warns Ontario faces "serious shortage" of generating capacity.

Nov 11: Eves proposes measures to protect consumers from skyrocketing hydro bills, a freeze on rates and rebates to May 1 for consumers who paid rates above the cap.

Dec 9: Legislature passes law to implement Eves' measures to protect consumers.

Related News

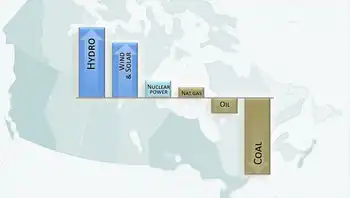

Energy minister unveils Ontario's plan to address growing energy needs

TORONTO - Powering Ontario's Growth accelerates clean electricity, pairing solar, wind, and hydro with energy storage, efficiency investments, and new nuclear, including SMRs, to meet rising demand and net-zero goals while addressing supply planning across the province.

Key Points

Ontario's clean energy plan adds renewables, storage, efficiency, and nuclear to meet rising electricity demand.

✅ Over $1B for energy-efficiency programs through 2030+

✅ Largest clean power procurement in Canadian history

✅ Mix of solar, wind, hydro, storage, nuclear, and SMRs

Energy Minister Todd Smith has announced a new plan that outlines the actions the government is taking to…