Utilities say grid can handle hybrids

By Globe and Mail

High Voltage Maintenance Training Online

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

The answer — a plasma television — is what is easing the minds of utility company executives across the U.S. as they plan for what is likely to be a conversion of much of the country's vehicle fleet from gasoline to electricity in the coming years.

Plasma TVs, industry officials say, consume about four times the electricity as recharging a plug-in hybrid. Yet utilities have managed to cope with the increased loads as thousands of new televisions came on line.

So as long as the changeover from internal combustion engines to electric vehicles is somewhat gradual, they should be able to handle it in the same way, Mark Duvall, program manager for electric transportation, power delivery and distribution for the Electric Power Research Institute, said.

"We've already added to the grid the equivalent of several years' production of plug-in hybrids," Duvall said at a conference on electric vehicles in San Jose. "The utilities, they stuck with it. They said, 'All right, that's what's happening. This is where the loads are going, and we're going to do this."'

Auto makers, such as General Motors Corp. and Toyota Motor Corp., are planning to bring rechargeable vehicles to the market as early as 2010. But speakers at the Plug-In 2008 conference say it will take much longer for them to arrive in mass numbers, due in part to a current lack of large-battery manufacturing capacity. Auto and battery companies still are working on the lithium-ion battery technology needed for the cars, and on how to link the battery packs to the vehicles.

"We see the vehicle penetration levels coming at a rate that's manageable," said Efrain Ornelas, environmental technical supervisor with Pacific Gas and Electric Co. in San Francisco. "It's not like tomorrow the flood gates are going to open and 100,000 vehicles are going to come into San Francisco or something like that."

Instead, the vehicles will show up by the thousands throughout Northern California, he predicted. PG&E will be able to track their charging patterns and plan accordingly for the future, he said.

Utility officials say they already are coping with increased demand, especially during peak-use periods in the afternoon and early evening. But the rest of the day, most utilities have excess generating capacity that could be used to recharge cars.

But the preparation doesn't mean electric vehicles will be accommodated without problems and good planning, the officials say.

Since most electric cars will likely be charged during off-peak electric use times, utilities should have no problem generating enough electricity. But since people with the means to buy electric cars likely will live in the same areas, utilities worry about stress on their distribution systems, Ornelas said.

That means consumers will face a lot of choices about when and where they charge up their cars and how much they want to pay for the electricity.

The choice for consumers will come because utilities likely will raise rates to charge cars during peak use times, generally from around noon to 8 p.m., and lower them for charging during low-use hours, industry officials say.

In California, utilities already are installing meters that track use by time of day. PG&E charges 30 cents per kilowatt hour to charge an electric vehicle during peak hours, he said, but charges only five cents from midnight to 7 p.m.

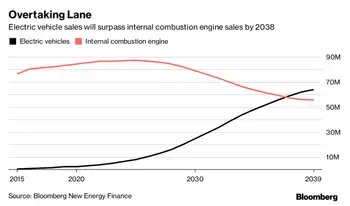

Duvall said utilities still have to be wary that high gasoline prices could push sales of rechargeable electric vehicles well into the millions by 2020, because that could stress the system. Other possible problems include electric vehicles getting larger and requiring far more electricity for recharging, and demands from people that their vehicles be recharged quickly, drawing more electricity during peak times.

Also, companies such as the Campbell-based Coulomb Technologies, are starting to develop recharging stations for sale to parking lot operators, office buildings and cities, which will draw more electricity.

There's also talk of the cars storing electricity and sending it back to the power companies during peak times, but officials say that's a long way off.

Industry officials say they can manage the fleet changeover as the cars and the utilities each have computers in place to manage when the cars are recharged.

"From our perspective I think it's something that's really manageable," said Ornelas.