Oregon Regulators Approve Rate Hikes for Some Smaller Electricity Users

By Associated Press

Arc Flash Training CSA Z462 - Electrical Safety Essentials

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

The rate hike affects about 75 percent of electricity customers in Oregon.

Portland General Electric and PacifiCorp customers saw a 13 percent hike in their bills on June 1. Affected customers of Idaho Power saw their rates increase by 6 percent at the same time. The change does not affect industrial customers.

PacifiCorp is owned by MidAmerican Energy Holdings Co., which is controlled by billionaire Warren Buffett. Berkshire Hathaway is his investment group. IdaCorp Inc. operates Idaho Power.

The rate hike is a ripple effect of a recent federal appeals court ruling in a lawsuit filed against the Bonneville Power Administration by public utilities.

The BPA is a not-for-profit federal agency that markets about 40 percent of the electricity consumed in the region and sells to about 140 utilities in Washington, Oregon, Idaho and Montana — most of them public utilities.

In a May 3 ruling, the 9th U.S. Circuit Court of Appeals said the BPA had previously overstepped its authority when it set an annual subsidy to reduce electricity rates for residential and small farm customers of the privately owned utilities.

The BPA and its utility customers have long fought over the appropriate level of the subsidy, known as the "residential exchange" program.

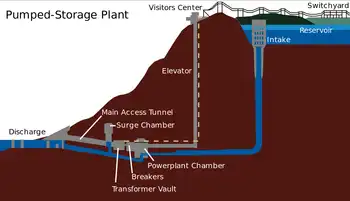

The exchange — established by the Northwest Power Act in 1980 — allows private utilities to swap higher-cost power they generate for lower-cost hydropower generated by the BPA. The exchange usually comes in the form of a financial payment, not an actual power exchange, and customers see it as a credit on their monthly bills.

The court decision did not require BPA to stop the payments. But earlier, BPA said it was immediately suspending payment of $28 million a month in residential exchange benefits because of uncertainty over the ruling.

"This is a distasteful thing to be forced to do," Lee Beyer, chairman of the Oregon utility commission, said in a statement regarding the recent rate hike. "Unfortunately BPA's decision to cut off customers of private utilities from the benefits of the Columbia River hydro system made this action necessary."

BPA said the agency is working with several groups in the Northwest to find a solution. The agency is also seeking a rehearing of the ruling by a larger panel of the 9th Circuit, but a final decision will be made by the Justice Department.

The issue has already built tension among the handful of large investor-owned utilities against scores of publicly owned utilities in a fight over access to BPA's low-cost hydropower.

However, some of the utilities say they are open to a compromise as well. PGE spokesman Steve Corson said the utility is fighting for customer rights but recognizes some options, such as a rehearing or legislative decisions, could take significant amounts of time to resolve.

Northwest senators have also urged the BPA to look for a compromise in the battle brewing between public and private utilities. Without such a compromise, Congress could step in, with unknown consequences for the BPA and the utilities it serves, the senators said.