Iraqis opt for generators for power

By Associated Press

Substation Relay Protection Training

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

Love them or hate them — usually both — but Baghdad residents are obsessed with the thousands of generators around the city that they rely on for electricity because the national power grid is so notoriously unreliable.

Love them because generators are the only way to ensure desperately needed air conditioners keep running in Iraq's sweltering summer, when temperatures can reach 120 degrees Fahrenheit. Hate them because of the deafening noise, the ugly maze of wires marring the city's face and, above all, the cost — an extra outlay of $50 a month or more for already cash-strapped Iraqis.

The ubiquitous cables snaking across streets and up buildings to link homes with neighborhood generators "are the veins of life," said Hussein, a 37-year-old schoolteacher and a mother of two boys.

"I would have left Iraq a long time ago if it was not for the generators because besides the unbearable heat, without power there is no water," she said, because people usually use electric pumps to get the water to the taps. "The first thing we do when we get our salaries is put aside the money for generator fees."

The summer heat has brought an electricity crisis for Iraq's government, faced with public anger over increasing costs and sporadic power. Two people were killed last weekend in the southern port city of Basra when protests over power shortages turned violent and security forces fired into the crowd. Similar demonstrations have been held nearly every day since, forcing the resignation of Electricity Minister Karim Waheed.

His acting replacement, Hussain al-Shahristani, pleaded with Iraqis to cut down on air conditioner use and warned government employees not to use their positions to ensure a constant supply from the national grid. Prime Minister Nouri al-Maliki has urged Iraqis to be patient, saying it likely will take more than two years for the electricity grid to be fixed.

Billions of dollars have been spent rebuilding Iraq's electricity network, which was damaged by U.S. attacks in the 1991 Gulf War and the 2003 invasion and subsequent looting and insurgent targeting. But still, most neighborhoods in the capital get only five to seven hours of power a day from the grid. In places outside of Baghdad, it could be even less. At the same time, demand skyrocketed after the fall of Saddam Hussein when Iraqis could finally buy appliances that weren't previously available.

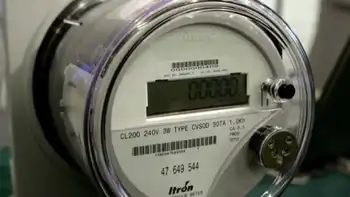

Moreover, the amount each family can draw from the grid when it is working is rationed to 10 amperes — not enough to run most air conditioners. So stealing from the grid is rampant as families rewire to get around the meters that enforce the ration. The mooching is so widespread and puts such a burden on the system that the Electricity Ministry earlier this year threatened the death penalty for anyone caught doing it.

Also, the price for power from the grid doubled as of June 1, and many are worried about what the next bills will bring.