U.S. Climate Change Donation Survey reveals Americans' willingness to fund sustainability via government incentives, electrification, and renewable energy. Public opinion favors wind, solar, and decarbonization, highlighting policy support post-pandemic amid economic recovery efforts.

Key Points

A 2020 U.S. poll on climate attitudes: donation willingness, renewable support, and views on government incentives.

✅ 70% would donate income; 31% would donate nothing.

✅ 59% prefer government incentives; 47% support taxes, conservation.

✅ 85% land wind, 83% offshore wind, 90% solar support.

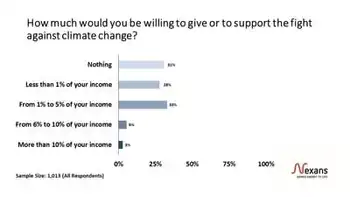

A new study of American consumers' attitudes toward climate change finds that more than two-thirds of respondents (70%) indicate their willingness to give or donate a percentage of their personal income to support the fight against climate change and the path to net-zero electricity emissions by mid-century.

Twenty-eight percent indicated they were willing to provide less than 1% of their income; 33% said they would be willing to contribute 1-5% of their income; 6% said they would give between 6-10% of their income; and 3% indicated they would contribute more than 10% of their income. Just under one-third (31%) of those surveyed indicated they were unwilling to give or donate any percentage of their income to support the fight against climate change.

The U.S. findings are part of a series of surveys commissioned by Nexans in the U.S., UK and France, in order to determine public opinion on climate change and related issues in the wake of the COVID-19 pandemic. The U.S. study was conducted online by Researchscape from August 20 – 24, 2020. It had 1,013 respondents, ages 18 or older, with the results weighted to be representative of the overall population (variables available upon request).

Nexans, is headquartered in Paris with a major offshore wind cable manufacturing facility in Charleston, S.C. and an industrial cable manufacturing facility in El Dorado, Ark. The company is fully committed to fighting climate change and is helping to make sustainable electrification possible. The survey was developed as part of its celebration of the first Climate Day in Paris which included a roundtable event with world-renowned experts, the release of an unprecedented global study by Roland Berger on the challenges raised by the electrification of the world, the question of whether the global energy transition is on track, and Nexans' own commitment to be carbon neutral by 2030.

Paying the Tab to Address Climate Change

Participants were given the opportunity to choose from seven multiple responses to the question "How should the fight against climate change be paid for?" The majority (59%) replied it should be paid for by "government incentives for both businesses and consumers." It was followed by "federal, state and/or local taxes" and "conservation programs" (tied at 47%); "business investments" (42%), such as carbon-free electricity initiatives, and "consumer-driven purchases" (33%). Just 9% selected none of the above and 2% selected other.

"Through the organization of this Climate Day, Nexans is asserting itself not only as an actor but also a thought leader of the energy transition for a sustainable electrification of the world. This electrification raises a number of challenges and paradoxes that must be overcome. And it will only happen with the direct involvement of the populations concerned. These surveys provide a better understanding of the level of information and disinformation, including climate change denial, in public opinion as well as their level of acceptability of these lifestyle changes," said Christopher Guérin, CEO, Nexans.

Among other findings, 44% are dissatisfied with the job that federal and state governments are doing to address climate change, while utilities like Duke Energy face investor pressure to release climate reports, 35% are somewhat satisfied and 21% are either very satisfied or completed satisfied with government's role.

Americans expressed overwhelmingly favorable views of wind and solar renewable energy proposals, as carbon emissions fall when electricity producers move away from coal. Specifically, 85% stated being in favor of wind turbines on land (15% against), 83% in favor of wind turbines off the coast (17% against) and 90% in support of solar panel farms (10% opposed).

Those surveyed were asked about their current and changing priorities towards climate change as influenced by the coronavirus pandemic and impacts like extreme heat on electricity bills. Thirty-nine percent indicated that climate change was no more and no less a priority due to the current health emergency; just under a third (31%) indicated that climate change is more of a priority while 30% said it was less of a priority.

In similar research conducted by Nexans in the United Kingdom, nearly two thirds (65.8%) of UK respondents said they would be willing to donate part of their salary to fight climate change. Furthermore, nearly a third (29%) of the UK's consumers believe that combating climate change has become more of a priority in light of the coronavirus pandemic. The UK research was conducted online by Savanta from August 21 – 24, 2020. A total of 2210 respondents, aged 16 and above, representative of the UK population took part.

Related News