Kentucky Tornado Recovery details Mayfield damage, death toll, power outages, boil-water advisories, shelter operations, and emergency response across five states, as crews restore infrastructure, locate missing persons, and support displaced families in frigid temperatures.

Key Points

Overview of restoring utilities, repairing infrastructure, and sheltering survivors after Kentucky's tornado disaster.

✅ Power, water, and gas outages persist; boil-water advisories in effect.

✅ Mayfield hardest hit; factory casualties lower than first feared.

✅ Shelter provided in state park lodges; long-term recovery expected.

Residents of Kentucky counties where tornadoes killed several dozen people could be without heat, water or electricity in frigid temperatures for weeks or longer, state officials warned Monday, and experiences abroad like Kyiv's difficult winter underscore the risks as the toll of damage and deaths came into clearer focus in five states slammed by the swarm of twisters.

Authorities are still tallying the devastation from Friday's storms, though they believe the death toll will be lower than initially feared since it appeared many more people escaped a candle factory in Mayfield, Ky., than first thought.

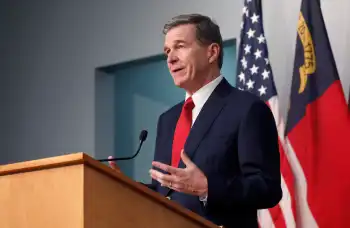

At least 88 people — including 74 in Kentucky — were killed by the tornados which also destroyed a nursing home in Arkansas, heavily damaged an Amazon distribution centre in Illinois and spread their deadly effects into Tennessee and Missouri, while ongoing nuclear worker safety concerns highlighted vulnerabilities across critical facilities. Another 105 people were still unaccounted for in Kentucky as of Monday afternoon, Gov. Andy Beshear said.

As searches continued for those still missing, efforts also turned to repairing the power grid, downed line safety education, sheltering those whose homes were destroyed and delivering drinking water and other supplies.

"We're not going to let any of our families go homeless," Beshear said in announcing that lodges in state parks were being used to provide shelter.

In Bowling Green, Ky., 11 people died on the same street, including two infants found among the bodies of five relatives near a residence, Warren County coroner Kevin Kirby said.

In Mayfield, one of the hardest hit towns, those who survived faced a high around 10 C and a low below freezing Monday without any utilities, and awareness of power strip fire risks is critical as residents turn to makeshift heating and power.

"Our infrastructure is so damaged. We have no running water. Our water tower was lost. Our waste water management was lost, and there's no natural gas to the city. So we have nothing to rely on there," Mayfield Mayor Kathy Stewart O'Nan said on CBS Mornings. "So that is purely survival at this point for so many of our people."

Across the state, about 26,000 homes and businesses were without electricity, according to poweroutage.us, including nearly all of those in Mayfield, and the U.S. grid warning during the pandemic underscored vulnerabilities in critical infrastructure.

More than 10,000 homes and businesses have no water, and another 17,000 are under boil-water advisories, Kentucky Emergency Management Director Michael Dossett told reporters.

Dossett warned that full recovery in the hardest-hit places could take not just months, but years, noting that utilities have at times contemplated on-site staffing to maintain operations during crises.

At least 74 people have been confirmed dead across Kentucky after tornadoes tore through the state, leaving some communities nearly totally destroyed and many residents wondering if they can afford to rebuild. 2:22

"This will go on for years to come," he said.

Amid broader economic strain, recent debates over Kentucky miners' pay highlight ongoing financial vulnerabilities for workers affected by disasters as well.

Authorities are still trying to determine the total number of dead, and the storms made door-to-door searches impossible in some places. "There are no doors," said Beshear.

"We're going to have over 1,000 homes that are gone, just gone," he said.

Beshear had said Sunday morning that the state's toll could exceed 100. But he later said it might be as low as 50.

'Then he was gone'

Initially as many as 70 people were feared dead in the candle factory in Mayfield, but the company said Sunday that eight were confirmed dead and eight remained missing, while more than 90 others had been located.

"Many of the employees were gathered in the tornado shelter and after the storm was over they left the plant and went to their homes," said Bob Ferguson, a spokesman for the company. "With the power out and no landline they were hard to reach initially. We're hoping to find more of those eight unaccounted as we try their home residences."

Related News