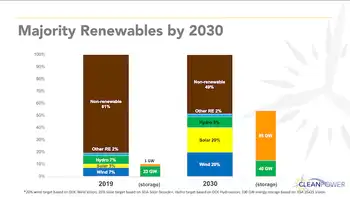

U.S. Majority Renewables by 2030 targets over half of electricity from wind, solar, hydropower, and energy storage, enabling a resilient, efficient grid, deep carbon reductions, fair market rules, and job growth across regions.

Key Points

A joint industry pledge for over 50% U.S. power from wind, solar, hydropower, and storage by 2030.

✅ Joint pledge by AWEA, SEIA, NHA, and ESA for a cleaner grid

✅ Focus on resilience, efficiency, affordability, and fair competition

✅ Storage enables flexibility to integrate variable renewables

Within a decade, more than half of the electricity generated in the U.S. will come from clean, renewable resources, with analyses indicating that wind and solar could meet 80% of U.S. electricity demand, supported by energy storage, according to a joint commitment today from the American wind, solar, hydropower, and energy storage industries. The American Wind Energy Association (AWEA), Solar Energy Industries Association (SEIA), National Hydropower Association (NHA), and Energy Storage Association (ESA) have agreed to actively collaborate across their industry segments to achieve this target.

The four industries have released a set of joint advocacy principles that will enable them to realize this bold vision of a majority renewables grid. Along with increased collaboration, these shared principles include building a more resilient, efficient, sustainable, and affordable grid; achieving carbon reductions; and advancing greater competition through electricity market reforms and fair market rules. Each of these areas is critical to attaining the shared vision for 2030.

The leaders of the four industry associations gathered to announce the shared vision, aligned with a broader 100% renewables pathway pursued nationwide, during the first CLEANPOWER annual conference for businesses across the renewable and clean energy spectrum.

American Wind Energy Association

"This collaborative promise sets the stage to deliver on the American electric grid of the future powered by wind, solar, hydropower, and storage," said Tom Kiernan, CEO of the American Wind Energy Association. "Market opportunities for projects that include a mix of technologies have opened up that didn't exist even a few years ago. And demand is growing for integrated renewable energy options. Individually and cooperatively, these sectors will continue growing to meet that demand and create hundreds of thousands of new jobs to strengthen economies from coast to coast, building a better, cleaner tomorrow. In the face of significant challenges the country is currently facing across pandemic response, economic, climate and social injustice problems, we are prepared to help lead toward a healthier and more equitable future."

Solar Energy Industries Association

"These principles are just another step toward realizing our vision for a Solar+ Decade," said Abigail Ross Hopper, president and CEO of the Solar Energy Industries Association. "In the face of this dreadful pandemic, our nation must chart a path forward that puts a premium on innovation, jobs recovery and a smarter approach to energy generation, reflecting expected solar and storage growth across the market. The right policies will make a growing American economy fueled by clean energy a reality for all Americans."

National Hydropower Association

"The path towards an affordable, reliable, carbon-free electricity grid, supported by an ongoing grid overhaul for renewables, starts by harnessing the immense potential of hydropower, wind, solar and storage to work together," said Malcolm Woolf, President and CEO of the National Hydropower Association. "Today, hydropower and pumped storage are force multipliers that provide the grid with the flexibility needed to integrate other renewables onto the grid. By adding new generation onto existing non-powered dams and developing 15 GW of new pumped storage hydropower capacity, we can help accelerate the development of a clean energy electricity grid."

Energy Storage Association

"We are pleased to join forces with our clean energy friends to substantially reduce carbon emissions by 2030, guided by practical decarbonization strategies, building a more resilient, efficient, sustainable, and affordable grid for generations to come," said ESA CEO Kelly Speakes-Backman. "A majority of generation supplied by renewable energy represents a significant change in the way we operate the grid, and the storage industry is a fundamental asset to provide the flexibility that a more modern, decarbonized grid will require. We look forward to actively collaborating with our colleagues to make this vision a reality by 2030."

Related News