BC Transmission chooses 3M conductor

By Business Wire

Arc Flash Training CSA Z462 - Electrical Safety Essentials

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

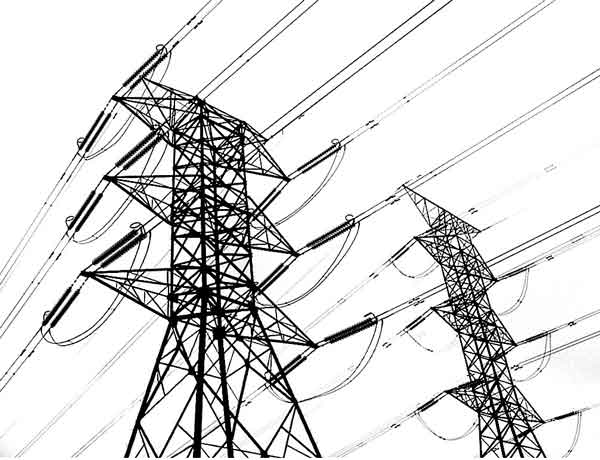

3M ACCR can carry twice the current of conventional steel-core conductors of the same diameter, without requiring larger towers, even across long spans.

BCTC will deploy 3M ACCR in two cross-water segments through islands in the Straight of Georgia as part of an upgrade for a transmission line linking Vancouver Island with British ColumbiaÂ’s lower mainland. The upgrade is known as the Vancouver Island Transmission Reinforcement (VITR) Project.

The 3M ACCR segments, which include a 5,800-foot (1,770-meter) single-span crossing the Sansum Channel between Vancouver Island and Salt Spring Island, in addition to a 6,000-foot (1,830-meter) multi-span crossing, are located about 25 miles north of Victoria, the provincial capital. The installation is currently in progress and scheduled to be completed in June 2008.

According to Tim Koenig, director of the 3M High Capacity Conductor Program, 3M ACCR was chosen, in part, to permit the re-use of existing towers, and avoid potential environmental sensitivities and costs associated with building larger towers for the conventional ACSR conductors.

“Larger towers to accommodate double bundling, for example, would have required bringing heavy equipment into remote areas, some by barge, installing new foundations and guide wires, installing new towers, digging out the existing footings and then transporting the aggregate for an additional 24 towers,” says Koenig. “Moreover, one of the segments goes through part of a provincial park. Preserving the existing sightline and minimizing installation requirements are definitely pluses.”

3M ACCR is currently in service for several domestic utilities, including Xcel Energy in Minneapolis, Platte River Power Authority in Colorado, Arizona Public Service in Phoenix, and Allegheny Power near Washington D.C. In addition, Shanghai Electric Power Company Ltd. and Companhia de Transmissão de Energia Elétrica Paulista (CTEEP) became the first utilities outside of North America to purchase 3M ACCR, choosing it to boost transmission capacity in China and Brazil, respectively.

“There is a growing realization that an exhaustively tested and reliable solution exists for many of the power constraint problems that affect the grid today,” says Koenig. “And that solution is 3M ACCR. It’s cost-effective for many applications, and is becoming widely used in the U.S. and abroad.”

3M ACCR was developed with the support of the U.S. Department of Energy, which tested the conductor at Oak Ridge National Laboratory (ORNL) in Tennessee, and with early contributions by the Defense Advanced Research Projects Agency. The ORNL tests demonstrated the conductorÂ’s integrity after exposure to temperatures even higher than the rated continuous operating temperature of 210 degrees Celsius, which provides a significant safety factor. Since 3M ACCR is based on aluminum, it is not adversely affected by environmental conditions, such as moisture or UV exposure, and it has the durability typically associated with all-aluminum conductors.

In addition to testing installations at Oak Ridge, 3M ACCR has been in use, both in continuous field tests and commercial operation, for several years, under a wide range of harsh climate conditions. The conductor has met all performance and reliability expectations and has never experienced a failure in the field, in either installation or operation.

3M ACCRÂ’s strength and durability result from its core, composed of aluminum oxide (alumina) fibers embedded in high-purity aluminum, utilizing a highly specialized and patented process. The constituent materials are chemically compatible with each other and can withstand high temperatures without adverse chemical reactions or any appreciable loss in strength. The conductor also is highly resistant to corrosion.