Locke to hawk U.S. clean energy to China

By Reuters

Substation Relay Protection Training

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

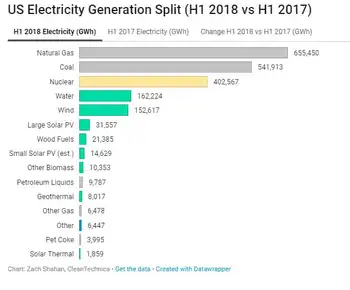

China, the world's largest emitter of carbon dioxide and other greenhouse gases blamed for global warming, is plowing tens of billions of dollars — if not more — into wind, solar, nuclear and other non-fossil energy projects, a market U.S. companies are eager to tap.

Predictions that China's domestic reserves of oil and natural gas could be depleted within 20 years are helping to propel its drive into clean energy.

"In the past six months, China had the largest increase in human-generated greenhouse gases of any country in history. And in the first quarter of this year alone, coal and oil sales in China jumped 24 percent, which is twice as fast as their economy grew," Locke told reporters this week.

The companies on the trip "represent a cross-section of the best that America has to offer on clean energy, energy efficiency and electricity storage, transmission and distribution," Locke said.

In addition to bringing U.S. and Chinese companies together, Locke said, he planned to raise a "whole host of trade barrier issues" on the trip and during high-level U.S.-China talks set for May 24-25 in Beijing. The annual Strategic and Economic Dialogue is the two countries' main forum for addressing foreign policy and economic concerns.

Locke said U.S. officials would press their counterparts on China's currency practices and "indigenous innovation" policies that disadvantage U.S. firms.

Locke, a former governor of Washington State and one of two Chinese-Americans in President Barack Obama's cabinet, is leading a trade mission that includes turbine manufacturing giants General Electric and Pratt & Whitney Power Systems, a division of United Technologies.

The group also includes First Solar, a leading manufacturing of solar modules that last year had $2.1 billion in sales, and Peabody Energy, the world's largest private-sector coal company.

Locke begins his trip in Hong Kong and travels to Shanghai and Beijing. He then will lead many of the same companies on a second clean energy trade mission to Indonesia.

China is the world's largest coal producer and consumer, which is both "a threat for global warming" and an opportunity for companies that can help it burn coal more efficiently, said David Sandalow, an assistant U.S. energy secretary.

Recognizing its problem, the Chinese government has set a target of reducing carbon emissions per unit of economic output by 40 percent to 45 percent below 2005 levels by 2020. It also has mandated at least 15 percent of China's primary energy come from non-fossil fuel sources by the same deadline.

To meet those ambitious targets, China is investing heavily in clean coal technology and in projects to capture carbon emissions and store them underground.

It also has toughened fuel economy standards and has "an aggressive program for electrification of the vehicle fleet," Sandalow said at a recent event hosted by the Nixon Center.

U.S. Energy Department analysts expect China to spend an eye-popping $1 trillion to expand its rail network over the next decade and to put up as many new buildings over the next 25 years as are now in the United States.

China is constructing 21 nuclear reactors, in addition to 11 now operating, and has more than tripled its wind power capacity in recent years to 21 gigawatts, with plans to push that to 30 gigawatts by 2020, Sandalow said.

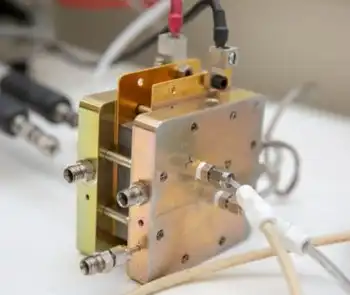

It is also "building ways to move electrons from the West to the East," as a lot of China's power resources are long distances from its big population areas, he said.

That entails installing 4,000 miles of advanced ultra-high-voltage lines. The best are capable of transmitting 1,000 kilovolts, compared with state-of-the-art lines in the United States that handle 765 kilovolts, Sandalow said.

But how much U.S. or other foreign companies can grab of China's clean energy market is a big question, said Alan Wolff, a lawyer for Dewey & LeBoeuf, who helped put together a study on the issue for a leading U.S. business group.

The report found that foreign companies' share of China's wind power equipment market fell from 75 percent in 2004 to 24 percent in 2008, with some projections that it could drop to 5 percent by the end of this year.

"In wind, things are very, very bad in terms of current market access," and in the solar sector there is overcapacity currently in the global market, Wolff said.

Companies are also concerned about Chinese "indigenous innovation" policies that require them to develop and register their intellectual property in China if they want to be considered for certain business opportunities.

"That will be a major topic of discussion," Locke said, adding Obama administration officials have already conveyed their concerns in a letter to the Chinese.