LoonieÂ’s pain is CamecoÂ’s gain

"Recent uncertainty in world financial markets has affected companies around the globe, including Cameco," the Saskatoon-based company said in a third-quarter earnings release.

"The capital market for debt, for Cameco and most other companies, has effectively shut down. In response, the company is re-examining its expenditures during the current budget planning process."

Still, Cameco, which holds a majority of its uranium production in Canada but sells the material in U.S. dollars, said the recent rise of the greenback would continue to have a "favourable impact" on revenues.

Cameco, the biggest producer of uranium in the world, said it expects revenue across its businesses, including a majority stake in gold miner Centerra Gold as well as interests in nuclear electricity generation, to improve between 10% and 15% over 2007, it said.

In the company's third quarter ended Sept. 30, Cameco reported net income of $135-million (39 cents a share), compared with $91-million (25 cents) a year ago. Total revenue climbed to $729-million, versus $681-million in 2007.

The year-end earnings outlook comes even as the company said uranium production dove 36% to 2.7 million pounds.

The company said production would continue to fall as delays and processing challenges at major projects is anticipated to persist, resulting in total annual output of 17.7 million pounds compared to a previous forecast of 19.6 million.

Related News

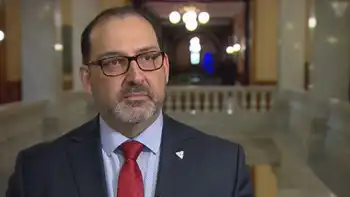

Ontario Energy minister downplays dispute between auditor, electricity regulator

TORONTO - The bad blood between the Ontario government and auditor general bubbled to the surface once again Monday, with the Liberal energy minister downplaying a dispute between the auditor and the Crown corporation that manages the province's electricity market.

Glenn Thibeault said concerns raised by auditor general Bonnie Lysyk during testimony before a legislative committee last week aren't new and the practices being used by the Independent Electricity System Operator are commonly endorsed by major auditing firms.

"(Lysyk) doesn't like the rate-regulated accounting. We've always said we've relied on the other experts within the field as well, plus the provincial controller," Thibeault said.

#google#

"We believe that we are following…