Leominster mayor tests power of $1 to help heat homes

By Boston Globe

Protective Relay Training - Basic

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

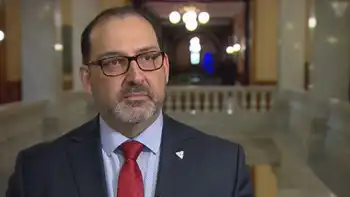

"There is more demand (for heating assistance) than there is supply," Mazzarella said in a telephone interview. "We are just asking everyone to give a dollar, anyone who might have lived here and anybody who lives here. Everybody can afford a dollar."

Mazzarella said that since he first announced his latest fund-raising idea this week, people have walked up to him and literally handed him cash to help dozens of residents.

At a Veterans Day event, an elderly woman approached Mazzarella and gave him $10. "We can't afford a lot," the woman told the mayor. "But here's 10 bucks from my family."

Mazzarella said his office had already handed out $40,000 in energy assistance grants, an amount cobbled together from federal and state grants, donations, and fund-raisers.

He said many of those getting aid in the city are still paying off utility bills from the last heating season. Many, he said, ran out of oil and turned to space heaters to keep warm, and now have large electricity bills.

He said the drop in oil prices will make donations go further, but stressed that there has not been any decrease in demand, particularly with the economic downturn hitting the nation.

Mazzarella said that both the state and federal governments are facing budget struggles, sharply reducing the likelihood that more government money will fill the gap in his city of about 41,000.

"We can't count on government," he said. "This is a chance to help each other. Every dollar helps, believe it or not."

Richard Marchand, president of the Leominster City Council, said in a separate telephone interview that he is a big fan of Mazzarella's idea. Marchand and his wife plan to donate $100, and he expects others to reach for a dollar bill and decide to donate even more, he said.

"It's a wonderful idea," said Marchand, a teacher at Shrewsbury High School. "This is an effort to take a little bit of the edge off one of the most difficult economic times in history."

Marchand said he knows people who have filed for bankruptcy and are facing foreclosure. He is also hearing worry in the voices of teens at school, concerned their parents may lose their jobs.

"This is a greater opportunity for the people who can help to help in a small way," Marchand said. "As we button up the hatches for winter, we know it's going to be a challenge for everybody to have heat in their homes."

The mayor said he will keep the dollar fund-raiser going with the hope of collecting another $40,000.

Donations can be sent to Leominster City Hall, he said.