Clean Energy Tax Incentives could expand under Democratic proposals, including ITC, PTC, and EV tax credits, boosting renewable energy, energy storage, and grid modernization within a broader infrastructure package influenced by Green New Deal goals.

Key Points

Federal incentives like ITC, PTC, and EV credits that cut costs and speed renewables, storage, and grid upgrades.

✅ Proposes permanence for ITC, PTC, and EV tax credits

✅ Could accelerate solar, wind, storage, and grid upgrades

✅ Passage depends on bipartisan infrastructure compromise

The 115th U.S. Congress has not even adjourned for the winter, and already a newly resurgent Democratic Party is making demands that reflect its majority status in the U.S. House come January.

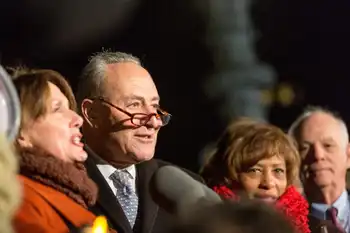

Climate appears to be near the top of the list. Last Thursday, Senator Chuck Schumer (D-NY), the Democratic Leader in the Senate, sent a letter to President Trump demanding that any infrastructure package taken up in 2019 include “policies and funding to transition to a clean energy economy and mitigate the risks that the United States is already facing due to climate change.”

And in a list of policies that Schumer says should be included, the top item is “permanent tax incentives for domestic production of clean electricity and storage, energy efficient homes and commercial buildings, electric vehicles, and modernizing the electric grid.”

In concrete terms, this could mean an extension of the Investment Tax Credit (ITC) for solar and energy storage, the Production Tax Credit (PTC) for wind and the federal electric vehicle (EV) tax credit program as well.

Pressure from the Left

This strong statement on climate change, clean energy and infrastructure investment comes as at least 30 incoming members of the U.S. House of Representatives have signed onto a call for the creation of a committee to explore a “Green New Deal” and to move the nation to 100% renewable energy by 2030.*

It also comes as Schumer has come under fire by activists for rumors that he plans to replace Senator Maria Cantwell (D-Washington) with coal state Democrat Joe Manchin (D-West Virginia) as the top Democrat on the Senate Energy and Natural Resources Committee.

As such, one possible way to read these moves is that centrist leaders like Schumer are responding to pressure from an energized and newly elected Left wing of the Democratic Party. It is notable that Schumer’s program includes many of the aims of the Green New Deal, while avoiding any explicit use of that phrase.

Implications of a potential ITC extension

The details of levels and timelines are important here, particularly for the ITC.

The ITC was set to expire at the end of 2016, but was extended in legislative horse-trading at the end of 2015 to a schedule where it remains at 30% through the end of 2019 and then steps down for the next three years, and disappears entirely for residential projects. Since that extension the IRS has issued guidance around the use of co-located energy storage, as well as setting a standard under which PV projects can claim the ITC for the year that they begin construction.

This language around construction means that projects can start work in 2019, complete in 2023 and still claim the 30% ITC, and this may be why we at pv magazine USA are seeing an unprecedented boom in project pipelines across the United States.

Of course, if the ITC were to become permanent some of those projects would be pushed out to later years. But as we saw in 2016, despite an extension of the ITC many projects were still completed before the deadline, leading to the largest volume of PV installed in the United States in any one year to date.

This means that if the ITC were extended by the end of 2020, we could see the same thing all over again – a boom in projects created by the expected sunset, and then after a slight lull a continuation of growth.

Or it is possible that a combination of raw economics, increased investor and utility interest, and accelerating renewable energy mandates will cause solar growth rates to continue every year, and that any changes in the ITC will only be a bump against a larger trend.

While the basis for expiration of the EV tax credit is the number of vehicles sold, not any year, both the battery storage and EV industries, which many see at an inflection point, could see similar effects if the ITC and EV tax credits are made permanent.

Will consensus be reached?

It is also unclear that any such infrastructure package will be taken up by Republicans, or that both parties will be able to come to a compromise on this issue. While the U.S. Congress passed an infrastructure bill in 2017, given the sharp and growing differences between the two parties, and divergent trade approaches such as the 100% tariff on Chinese-made EVs, it is not clear that they will be able to come to a meaningful compromise during the next two years.

Related News