Alternative Energy Cost - Green Energy Premiums

Alternative energy cost analyzes LCOE, CAPEX, OPEX, and grid parity across solar PV, wind turbines, and battery storage, considering efficiency, load factors, and grid integration to optimize system design and lifecycle economics.

What Is Alternative Energy Cost?

Alternative energy cost is LCOE-based pricing for solar, wind, and storage, reflecting CAPEX, OPEX, and grid impacts.

✅ Uses LCOE comparing PV, wind, and storage across duty cycles.

✅ Includes CAPEX, OPEX, maintenance, and financing assumptions.

✅ Evaluates grid integration, curtailment, and reliability metrics.

Alternative energy cost is determined by how utilities typically set their rates and account for the cost differential between alternative energy and conventional energy sources. Basically, cost recovery of a utility’s investments and operating expenses determine electricity rates. For background on definitions and resource types, see this overview of what is renewable energy to align terminology across programs.

These alternative energy costs include:

Understanding the breadth of technologies captured under renewable alternative energy helps clarify why cost components vary by resource.

- owning generation

- owning transmission and distribution assets

- a return on owned assets

- purchased power contracts

- recovery of various operating expenses, including fuel costs, maintenance, and administration.

Costs for generating, transmitting, and distributing electricity are in a utility’s rate. Because utility costs are bundled together, all generation resources are combined to create a utility “system mix” of generation. In other words, utilities do not normally distinguish between individual generation sources for their customers. Therefore, an equivalent mix of the utility’s generation resources and purchased power is provided to each customer. In practice, product structures for alternative energy power are designed to work within this system mix paradigm.

For alternative energy cost determination, utilities and regulators are interested in separating the specific alternative energy costs related to securing green power. In this way, green power products are unique, differentiated electricity products. Since customer participation is voluntary, only those customers that choose to sign up for these programs pay the incremental costs. Alternative energy power program participants typically pay the higher alternative energy cost in the form of a premium on their monthly bill. In some jurisdictions, available alternative energy incentives help offset premiums for early adopters.

Four Main Components In Determinating Alternative Energy Cost

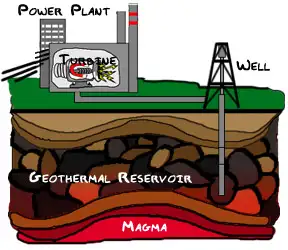

- 1. The cost of the alternative energy source. This includes the total cost of electricity and/or environmental attributes from all alternative energy resources used in the product, whether from wind, solar, geothermal, biomass, or another source, and whether owned by the utility or acquired through a power purchase contract. For example, cost trajectories for alternative energy solar power have declined sharply in recent years due to technology improvements.

- 2. Program implementation costs. Any additional alternative energy costs attributed to implementing the alternative energy program, including administration and marketing. Utilities sometimes leverage alternative energy grants to defray outreach and administration expenses.

- 3. Ancillary services costs. The additional costs incurred to integrate variable output resources, particularly wind, into a utility’s system.

- 4. Displaced utility generation (and capacity) resource costs. The renewable resource displaces electricity that the utility would otherwise have generated or purchased.

In conclusion, alternative energy costs can be represented as: Alternative energy premium = (1) + (2) + (3) – (4)

Alternative Energy Cost Determination

Alternative energy costs are captured through the specific power purchase agreements for alternative energy (in this case, the term alternative energy is interchanged with renewable energy) or RECs (renewable energy contracts), or through the regulatory approval process for utility-owned renewable projects. As long as these are tracked separately from the rest of the generation mix, the appropriate alternative generation costs can be determined. However, generation costs are hard to determine because it's uncertain how many customers plan to enroll in the program and how long they plan to participate. In electric markets that have not gone through restructuring from the electric industry, contracts for generation are typically long-term (10 years or more), and investment in owned facilities is generally considered to be for the life of the facility (20 years or more). For readers new to key terms and market structures, this primer on renewable energy facts provides helpful context for interpreting contract and REC pricing.

The long-term nature of the resource commitment severely contrasts with the program subscription commitment required of most customers. Most alternative energy programs do not require that customers enroll for a specific term, much less sign up for 10 or 20 years to match the facility or contract life of the renewable power supply source. Therefore, while the annual cost of renewable energy is straightforward to determine, the utility faces some level of risk that will likely be reflected in the product pricing.

However, if the utility is also subject to a renewable portfolio standard and is therefore required to procure a certain fraction of renewable energy for its overall load, there may be less risk, because the utility has greater flexibility in managing its overall renewable portfolio between its compliance and voluntary program obligations.