No receivership for Epic Energy's Aussie pipeline

MELBOURNE - - Epic Energy won a reprieve recently after a banking syndicate owed A$1.85 billion ($1.39 billion) on the company's flagship Australian pipeline voted against placing the asset into receivership.

"They took the receivership issue to a vote and didn't get the numbers but receivership and administration remain a possibility," a source close to the deal told Reuters.

Receivership and administration is a form of bankruptcy.

The 28-member banking syndicate has grown increasingly frustrated over the lack of progress on the sale of U.S.-controlled Epic Energy's Dampier-to-Bunbury pipeline in Western Australia state.

The sales process, which began last October, has been stymied by a dispute over gas sales contracts with key customers. Sources have said the recent sale of Epic's other assets, called "Epic Rest", has added to the uncertainty.

The sale of "Epic Rest" to minority shareholder Hastings Funds Management at the last minute caused underbidders to cry foul over the sales process.

One of the underbidders is among two consortia shortlisted for the Dampier-to-Bunbury pipeline. Placing the Dampier-to-Bunbury pipeline into receivership would have required approval from bankers representing two-thirds of the value of the debt. Australia's National Australia Bank and Westpac Banking Corporation , Deutsche Bank, Societe Generale and Toronto Dominion control 30 percent of the value of the A$1.85 billion debt. Epic Energy -- controlled by America's largest natural gas pipeline operator El Paso Corp and top U.S. utility Dominion Resources Inc -- recently won a fourth extension on the debt repayment to June 30.

Epic is aiming to reap as much above the loan figure as possible for the 1,530 km (955 mile)-long pipeline but analysts have valued the asset at only A$1.6 billion to A$1.8 billion.

Australian Pipeline Trust and Canada's Enbridge Inc have teamed up in a 50:50 consortium to bid for the pipeline. The other bidder is natural gas distributor Envestra Ltd and Cheung Kong Infrastructure Holdings Ltd , who sources say have put in a joint bid of A$1.9 billion.

The money loaned by the banks helped fund Epic's A$2.4 billion purchase of the pipeline from the Western Australian government in 1998.

The pipeline transports gas from the giant North West Shelf off the coast of Western Australia to domestic customers.

The sale of Epic comes amid a big shake-up of Australia's power and energy sector where around A$8 billion of assets are up for grabs.

Related News

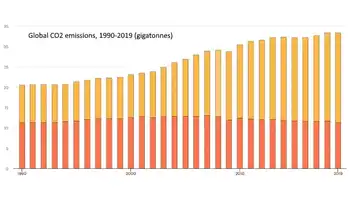

Global CO2 emissions 'flatlined' in 2019, says IEA

LONDON - Despite widespread expectations of another increase, global energy-related CO2 emissions stopped growing in 2019, according to International Energy Agency (IEA) data released today. After two years of growth, global emissions were unchanged at 33 gigatonnes in 2019 even as the world economy expanded by 2.9%.

This was primarily due to declining emissions from electricity generation in advanced economies, thanks to the expanding role of renewable sources (mainly wind and solar), fuel switching from coal to natural gas, and higher nuclear power generation, the Paris-based organisation says in the report.

"We now need to work hard to make sure that 2019…