Ontario Premier unveils province's conservation plan

By The Toronto Star

Substation Relay Protection Training

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

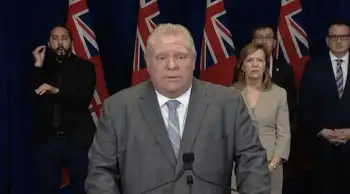

Cut hydro use: Premier McGuinty unveils province's conservation plan Warns of energy crisis if consumers don't act soon CAROLINE MALLAN QUEEN'S PARK BUREAU CHIEF Insisting Ontarians must adopt a new "culture of conservation" or else face severe power shortages in the years to come, McGuinty said recently he is confident that people will buy into the ambitious plan.

"If we don't act soon, we will face an energy crisis," McGuinty told the Legislature.

The province's new conservation strategy includes a public education campaign.

"That old, inefficient beer fridge in the basement may seem like your best friend at playoff time — but every time you open the door it's pay-up time, because that fridge can be costing you about $150 a year in extra electricity."

The Premier met Grade 6 students at Cedarvale Community School in north Toronto to discuss his government's plans to cut overall provincial consumption by 1,350 megawatts a day by 2007 — the same year that Ontario's five coal-fired generation plants are slated to close under a Liberal election promise.

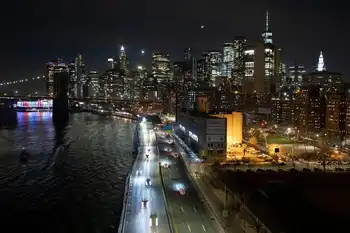

Province-wide consumption of electricity ranges between 23,000-25,000 megawatts a day during peak periods — a demand that was sorely tested last summer when the province struggled to recover from the Aug. 14 blackout that struck much of the northeastern United States and almost all of Ontario.

The province's current generation capacity is 30,500 when facilities across Ontario are all working.

The Premier said the province will embark on an ambitious plan to install so-called "smart meters" in 800,000 homes by 2007 and in all Ontario homes by 2010 so that consumers can see how much power they are using and opt to use their appliances at off-peak hours to cut back on their monthly bills.

He said that while his government has plans to increase electricity generation to keep up with demand that grows between 1.5 per cent and 1.7 per cent a year, individual users must do their part.

"We also have to slow the endless spiral of increasing demand, it simply is not sustainable," he said.

Smart meters — which track not just how much power is being used, but bills at different rates depending on the time of day — cost about $400 each.

But Energy Minister Dwight Duncan said local distribution companies, such as Toronto Hydro, will be expected to buy the meters in bulk to lower costs and to pay the upfront fee, recouping their investment through small monthly charges on hydro bills of roughly $2-$3.

Duncan said such a widespread installation plan of smart meters has never been undertaken before, but he added Ontario is determined to become a world leader in conservation and the meters are an essential starting point.

"This is the largest metering undertaking, I would imagine, in history in the province ... at least in this period of time, probably in the world," he said.

"We believe in this, we're going to make it work and we're going to be the world leader."

Duncan said achieving reductions of 1,350 megawatts by 2007 will basically keep consumption at current levels given the anticipated growth in demand in the coming years as the economy grows.

"If one thing should become clear to everybody, this is not a flash in the pan, this is a cultural shift. We are going to be teaching kids in school about conservation," he added.

Ontarians should be able to take advantage of off-peak, lower hydro rates by the middle of 2005, the minister said, but he could not say when meter installation will begin.

"I can't give you a precise date on that, but if we're going to have 800,000 in homes by 2007, it better be pretty soon."

The province will also allow people, organizations or companies that generate their own power — usually through solar panels or windmills — to be credited for excess power they feed back into the system.

Tory energy critic John O'Toole (Durham) labelled the Liberal conservation plan ineffective because conservation targets are too low and because new generation will not be in place in time to offset the loss of coal-fired power by 2007.

NDP Leader Howard Hampton said Ontarians need better incentives to conserve, including a wide-ranging policy to promote alternative energy such as solar.

He said most households cannot realistically use the bulk of their power in the off-peak hours after 10 p.m. and before 8 a.m.

"Are you going to shut off your fridge and your freezer at night? Are you going to cook your dinner at two o'clock in the morning? Are you going to shut off the heat at night? The answer to all three is `No,'" Hampton said in calling for large-scale investment by the province in clean energy generation.