Building industry favours net-zero energy homes

By Ottawa Citizen

Substation Relay Protection Training

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

By the time teenagers are hitting their mid-life-crisis years, roughly 2030, all new homes built should be net zero energy - they produce as much energy as they consume in a year.

That's a goal the Net-Zero Energy Home Coalition is working toward. And it's a vision shared by federal government housing policy people.

"This is not something that's rocket science," coalition chairman Gordon Shields told a recent gathering of building industry people interested in net-zero principles.

"We can do it and with today's technology."

Over at the CANMET Energy Technology Centre, director general John Marrone agrees. "Net-zero energy is the proverbial holy grail. By 2025 to 2030, this could be a reality, a standard home."

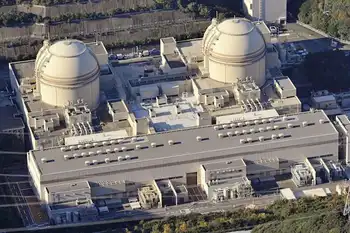

Houses produce 33 per cent of all greenhouse gases and every year we waste as much energy as 10 Pickering, Ont., nuclear power plants produce. Marrone says if you put today's electricity-generating solar photovoltaic panels on all Toronto homes, you could provide enough electricity for the province.

Woyteck Kujawski, a senior housing researcher at Canada Mortgage and Housing Corp., says CMHC would like new homes at net-zero standards by 2030.

Meanwhile, it will continue its EQuilibrium program to help 12 builders across Canada construct net-zero demonstration homes this year. And in the next five years, he wants 1,500 demonstration homes built.

The National Round Table on the Environment and the Economy, set up by the federal government to give advice on such issues, has a housing vision that extends to 2050.

By the time my teenagers are senior citizens, 70 per cent of Canadians will live in multiple dwellings, the round table says. Fully 33 per cent of single-family homes will have solar water heating and 10 per cent will make their own electricity with photovoltaic panels.

And here's an interesting prediction: 66 per cent of the buildings standing in the year 2050 have been built already. That means there will be a huge market for energy-efficient renovations. The remaining 34 per cent must be built to the highest standards or they'll join the list of buildings needing renovations.

Those numbers don't surprise Minto Developments architect Bill Ritcey, who agrees people will be living more densely in multiple dwellings.

Others at the net-zero seminar speculated homes may become their own little power generators. Who knows? Maybe Hydro Ottawa will pay homeowners to "rent" their roofs for solar panels. Ritcey isn't sure about that, although he envisions more community-based power projects, whether for solar electricity or geo-thermal power.