TOU rate to lift price 7 per cent

By Toronto Star

High Voltage Maintenance Training Online

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

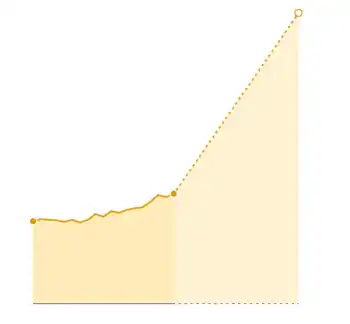

As Toronto Hydro switches its customers to timeofuse rates – which mean higher prices at peak periods – 92 per cent have seen the energy portion of their bill rise by about 7 per cent, said Toronto Hydro chief executive Anthony Haines. The average jump was $2.38 a month.

Starting July 1, the new, blended harmonized sales tax HST will be added to hydro bills, which previously were exempt from provincial sales tax.

That will push the total bill up another 8 per cent overall, or close to $8 a month.

Ontario Power Generation has announced its applying for a 9.6 per cent rate increase for its portion of the bill that will add about $2.75 a month to a typical bill. And Toronto Hydro has applied for an 8.7 per cent rate increase for its portion of the bill, which will add another $2.43 a month.

The province has added a fee to boost conservation that will add another $4 a year to a bill, or about 33 cents a month.

The total is an increase of about $15 a month, based on an average monthly bill of about $100. That assumes the customer uses about 800 kilowatt hours a month.

Figures are based on experiences of 10,000 households that were the first to switch to timeofuse rates.

Most customers are now on timeofuse rates.

And the rest will be switched shortly. Customers who have contracts with retailers will pay the contracted price, not the timeofuse rate.

The numbers are subject to change because the Ontario Energy Board hasnt yet approved the Toronto Hydro and OPG rates. And the structure of winter rates – which is when these bills were recorded – is different from summer. The summer impact of timeofuse rates may be less pronounced.

Timeofuse rates mean that the price rises to 9.3 cents a kilowatt hour at peak periods and falls to 4.4 cents when demand is low – overnight and on weekends.

Theres also a midpeak price range of eight cents.

Timeofuse rates are supposed to encourage customers to use less power during peak periods.

But Haines said that hasnt happened yet. In fact, peak usage rose slightly among the first customers who were switched to timeofuse rates.

Haines said as customers study their new bills and look at the new rates, theyll get a chance to react and switch some of their power usage to offpeak hours.

The price signal has been sent. I know Torontonians will respond, but they need to see that higher price point coming through, he said.

New smart meters have been installed across the city that enable the utility to charge timeofuse rates. The cost of installation – ordered by the province – was about $110 million.

Toronto Hydro and other utilities have programs to help customers decrease their use at peak times.

In Toronto, customers can get a device attached to their central air conditioner allowing the utility to switch it off for short periods when the system is under strain.

About 61,000 Toronto households have one they save 60 megawatts of power at peak periods, said Haines. Theres a potential for installing 200,000 of the devices, which theoretically could trim demand by 200 megawatts.

Thats 37 per cent of the output of the Portlands generating station.