Idaho energy czar aims to harness cow pie power

By Associated Press

Electrical Testing & Commissioning of Power Systems

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

Idaho is now America's No. 3 milk producer, trailing California and Wisconsin. That also means it's cow pie central.

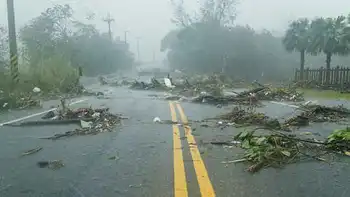

Mountains of manure are fueling Kjellander's dream of pipelines crisscrossing the Snake River plain, linking manure digesters at dairies large and small to central refineries that produce natural gas pure enough for homes or cars. Processed manure would be sold as plant bedding. Dairies could also fire turbines, shooting electricity into the power grid. And they could sell carbon credits in schemes to slash greenhouse gas emissions.

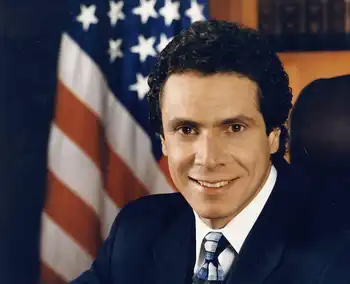

Kjellander, who heads up Gov. C.L. "Butch" Otter's Office of Energy Resources, is pushing a package of income tax credits, property tax waivers and other incentives in the 2009 Legislature starting January 12 to transform Idaho's southern heartland into a methane Mecca.

Minneapolis-based Cargill, Inc. is already building poop-to-power facilities here, while a tiny startup with big plans is struggling to survive.

"We can put together the right package and right mechanism to help move it along," Kjellander told The Associated Press. "You've got to have somebody locally who is ready to take the risk and move this forward. But the state can provide the right type of incentives."

Other states are also trying to whet potential investors' appetites.

Minnesota recently gave a farmer more than $200,000 to finance a project that returns unused electricity to its power grid. Washington offers sales tax exemptions for dairies that install digesters. And in the midst of 2001's rolling blackouts, California set aside $10 million for "manure methane power production projects."

Idaho's measure would eventually allow counties elsewhere, including depressed timber hamlets in the northern forests, to create alternative "energy enterprise zones" to assist companies in turning wood waste to energy.

With the pilot project focusing initially on the region around Twin Falls, however, Kjellander hopes to direct attention to where massive dairies have expanded en masse in recent years, lured by cheap land, cheap feed and utility costs that are just a third of California's.

Agriculture accounts for a third of U.S. methane released into the atmosphere. Methane, also from landfills, coal mines and oil refineries, is considered the No. 2 greenhouse gas contributing to global warming, after carbon dioxide.

The Idaho Conservation League has highlighted risks associated with Idaho's enormous dairy feedlots, including water quality threats and air pollution. The group supports Kjellander's bill.

"We're hoping the digesters will not only capture greenhouse gases, but also because of the way the system works, there will be additional controls of other air pollutants," said Courtney Washburn, from the environmental group's Boise office. "Hopefully, it will make the lives of the neighbors a lot easier."

Intermountain Gas Co., the state's provider, backs the plan, too.

The company, a unit of Bismarck, N.D.,-based Montana-Dakota Utilities Co., gets its natural gas largely from reservoirs in Canada and beneath the Rocky Mountains, including Wyoming and Utah. Incentives could help dairies cut the cost of their gas to competitive levels, said Brent Wilde, a spokesman.

"We're charged with purchasing the least expensive gas we can get our hands on," he said. "Probably the biggest benefit is being able to use that methane for something useful, rather than letting it go into the atmosphere."

In September, Cargill began selling electricity from its $8.5 million, 2.25 megawatt digester and generator facility at the 10,000-cow Bettencourt Dairy in Wendell to Idaho Power Co., the state's largest utility.

It is the agricultural conglomerate's first such project, but Cargill has another southern Idaho plant due to open in 2009. It's also exploring similar endeavors in neighboring Washington, Oregon, New Mexico, California, Texas, New York and Indiana, said Craig Maetzold, Cargill Environmental Finance's operations manager.

"We believe the credits in renewable energy are only going to increase in value in the future," Maetzold told The AP. "So far, we've looked at electricity generation as being the best business case. However, we are open to future projects that have pipeline-quality natural gas."

One healthy dairy cow produces 40,000 pounds of manure annually. Manure from 100,000 cows could produce enough natural gas to heat about 10,000 homes, said Jack Haffey, a former Montana Power Co. president who is now chief executive officer of Intrepid Technology and Resources.

His tiny Idaho Falls-based startup has invested about $12 million in projects at two Idaho dairies where Intrepid is now producing pipeline-quality natural gas. Still, the cash-strapped company has yet to begin deliveries to Intermountain Gas and has told investors it needs to find a strategic partner to stay afloat.

Haffey told The AP an incentive package like Kjellander's to accelerate construction of infrastructure would help, much the same as federal tax credits have boosted wind and geothermal energy projects across the country.

"At the right scale, thousands and thousands of homes could be heated with the clean natural gas we could produce," Haffey said. "Things like tax credits and other things to get us to a place where we can be financially viable would be helpful."