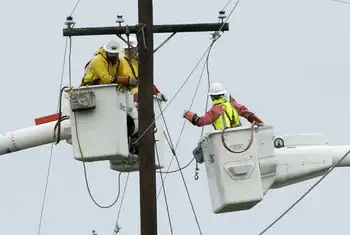

Power sector faces labour shortage

By Business Edge

NFPA 70b Training - Electrical Maintenance

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

An aging workforce, coupled with low recruiting numbers and a continual increase in demand from domestic and export markets, are converging to create a problem that could power down an industry that employs some 100,000 people.

The electricity industry faces an immediate shortfall of 1,300 positions every year for the next three years and needs to replace nearly 30 percent of industry positions, or approximately 25,000 people within the next six years, to meet Canada's energy demands - currently rising by one percent each year.

But while the numbers look bleak - estimates show that 28.8 percent of the electricity workforce is expected to retire between 2007 and 2012 - industry officials remain hopeful that a new report will be the warning shot that will help to turn things around.

The Electricity Sector Council (ESC) is bringing representatives from government, business, labour and education groups together to tackle the labour shortage, says Catherine Cottingham, executive director and CEO of the Ottawa-based ESC, which provides human resource and workplace development support to workers in the electrical industry and related fields.

But even so, the 2008 ESC Labour Market Information (LMI) study startled some stakeholders with its findings.

Cottingham says the new study follows up on another in 2005 that showed what the electricity business knew anecdotally about growing labour concerns, "but didn't realize it was so national in scope."

"Subsequent to that, business put in a lot of effort to address that," she says. "People have invested in apprenticeships, but the number of people going out the door is faster than we can keep up with. We're finding in some jurisdictions that they need more apprentices than they have journeyman to train them."

While the current study shows progress is being made, "it's not enough, which was a bit of a surprise," Cottingham adds.

Part of the problem is the traditionally stable nature of the electricity industry, according to Damon Rondeau, a human resource planner at Manitoba Hydro and chair of the ESC's labour market information project's steering committee.

"The entire electricity sector grew substantially in the 1960s and 1970s in response to growth in the Canadian economy and these people are all retiring now," says Rondeau. "We've always been a long-service, low-turnover industry. It's always been a bit of an older-age employee; that's fairly natural because of the long training lead-time and the highly skilled positions."

Retirements are likely going to stay high for another four to five years and then take another couple of years to stabilize, he says But Rondeau adds that the labour problem does not mean the power will go out any time soon.

"As somebody who has been watching this develop for some time, we're used to things moving fairly slowly in this segment of the economy - and they are on the move now," he says. "Sometimes we get the sense that there are drastic and dire shortages on the horizon, but the situation I see isn't so dire that the lights are going to go off."

Manitoba Hydro finds itself in a slightly different situation when it comes to labour concerns. While it also has older workers, it has positioned itself as a training utility, one that places a focus on grooming new staff in addition to its experienced workforce.

"Training lead times can range from four to seven years," says Rondeau. "The practice of a lot of utilities is to hire those who have procured their own training privately. Manitoba Hydro is a bit different that way. We've always recruited our trades' workforce right at the beginning of their career, even if they have no experience in the trades.

"Because we've done that for a long time and are good in planning what we need, we're not as surprised or alarmed by some of the findings of the LMI study as some of our peer companies might be."

Calgary-based Enmax, an energy distribution, supply and service company that is a wholly owned subsidiary of the City of Calgary, found itself in a precarious situation in 2007 when it had a shortage of power linemen.

After conventional methods failed, it hired eight linemen from the Philippines.

"We were one of the first utilities in Alberta to recruit linemen internationally," says Erin Kurchina, vice-president of human resources for Enmax, noting that of the eight, who were retained on two-year contracts, three have been hired on a permanent basis.

"We do forecast some (more) retirements," adds Kurchina. "They're not excessive and we've been able to manage our staffing levels through redeployments and the succession planning (for all staffing levels) that we've done. We've also partnered with the Calgary Catholic Immigration Society to help us explore the recruitment of international immigrants."

The ESC is also working on a number of initiatives to ensure that the sector has enough employees to meet the retirement crunch.

It's partnering with associations, labour organizations and educators in the energy sector and has provincial working groups in Ontario, Alberta and British Columbia working directly with the energy ministries in each of those provinces.

Its Electricity First work program provides wage subsidies to small and medium-size companies that offer employment to recent engineering and technical graduates. It's also working to create a national HR strategy and is developing sector-specific online tools such as templates and tracking forms to help organizations prepare for the radical demographic shift in the electricity workforce.

"If we don't get these workers I think there are going to have to be some adjustments," says Cottingham.

"One of the opportunities is technology - necessity spawns innovation. The other is to change the way we organize work, changing roles and responsibilities."

While the council feels it is making progress, "we are surprised that it's not closing the gap as much as we'd like," says Cottingham. "What that suggests is they're (the electrical companies) going to have to be more creative and focus more attention in those areas."