Stimulus money better spent on transmission

By Globe and Mail

Substation Relay Protection Training

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

The British government is contemplating a bailout of Jaguar Land Rover, the maker of some of the most socially useless machines known to mankind. Never mind that the luxury car and SUV brand is owned by India's Tata, one of the most profitable companies in Asia. Not to be outdone, Italy's ailing parmigiano cheese industry just snagged a €50-million ($84.5-million) government bailout. Among the Italians, apparently, parmigiano is considered an essential food and national asset. Could Brunello wines and prosciutto be next?

Canada is set to compete in the global stimulus and bailout sweepstakes too. A budget-busting package, reportedly worth as much as $25-billion, is being announced on January 27 by Finance Minister Jim Flaherty (the Canadian auto industry just got $4-billion from Ottawa and Ontario). It will probably shower goodies on everyone, from the rotting remnants of the pulp and paper industry to consumers.

Not all stimulus packages are created equal. Some simply buy some time for the walking dead. Others are so narrow and politically cynical - the bailout of Quebec shipbuilder MIL Davie comes to mind - that they qualify as pork. Still others are well-intentioned but spread so thin as to be worse than useless, like the recent value-added tax (VAT) reduction in Britain, which boosted the deficit and did nothing to fill the shops.

So what should Canada, or any other country about to air-drop buckets of cash on the landscape, aim for?

One good idea is to avoid stimulus projects that generate ongoing public liabilities. Take roads. Construction companies everywhere are lobbying hard for road-building. They argue that the ribbons of new asphalt will generate instant employment, make a region and its industries more competitive and put smiles on drivers' faces. They're right, to a degree. But a road is a public cost; maintaining one consumes tax revenue forever. Roads also have a nasty habit of attracting traffic, not curing it. Cars and trucks generate carbon dioxide.

If the same money were given, say, to help the rail industry upgrade and extend tracks and buy new locomotives, you would get a whole other picture. The continuing maintenance of a rail track is not a public cost. In Canada, it is the expense of Canadian National and Canadian Pacific. Rail companies also pay property tax on the rights of way. Roads are not part of the property-tax base.

Developing rail can work wonders for competitiveness and the environment. Moving freight by rail uses far less fuel per tonne, per kilometre than by truck. If Canada's decrepit fleet of diesel locomotives were replaced with the latest machines, rail would become even more efficient compared with trucks, while also reducing carbon dioxide output. And guess which company is one of the world's biggest makers of locomotives? Canada's very own Bombardier.

In the stimulus bang-for-your-buck department, filling attics with insulation would be hard to beat. It would provide employment for armies of installers and renovators, cut heating bills, and, like rail, help to reduce the country's carbon footprint.

Insulating the estimated two million homes of low-income earners across Canada would be the politically correct and financially sensible way to start. Lower heating bills would put more money in their pockets and take some of the pressure off the public purse, since many of the poor depend on government income such as welfare and unemployment benefits. One of the attractions of a national home insulation program is that it can be scaled up and down fairly quickly, depending on unemployment levels and the availability of labour.

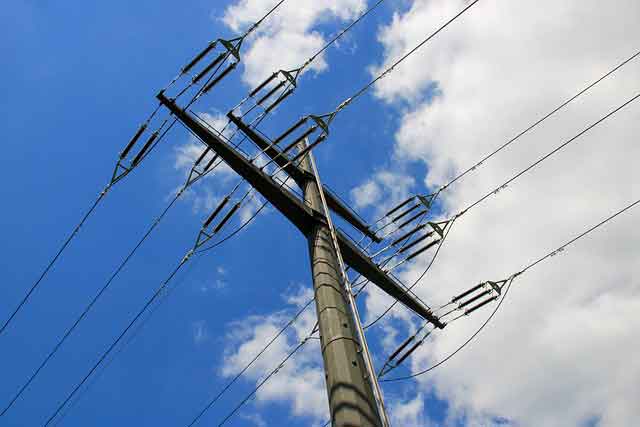

Another stimulus plan could focus on renewable energy, but with a twist. Instead of investing in the generating equipment itself, like wind vanes, solar panels and hydro turbines, the money could be put into electricity transmission systems. The capacity is desperately needed in Canada. Without new transmission systems, it makes no sense to build renewable energy projects for the simple reason they would be unable to deliver the juice to the user.

Building transmission systems would employ vast numbers of construction workers and engineers. It would also eliminate the risk of the government (or the public-private partnership) picking winners, say wind over solar. Governments are notoriously bad at such decisions. Once the transmission systems are built, governments and corporations could decide what mix of new generating capacity they want. Ontario might choose nuclear and wind energy, Alberta natural gas and hydro.

Will any of these ideas be put in place in the January stimulus package? Don't put money on it.

It appears that bailing out the industries threatening to fire thousands of workers will consume a big chunk of the spending.

Long-range, environmentally savvy plans like rail and home insulation will be hard sells because the voices calling for them will get lost in the roar of the pleas from the big, failing companies.