Medicine Hat Smart Grid AI modernizes electricity distribution with automation, sensors, and demand response, enhancing energy efficiency and renewable integration while using predictive analytics and real-time data to reduce consumption and optimize grid operations.

Key Points

An initiative using smart grid tech and AI to optimize energy use, cut waste, and improve renewable integration.

✅ Predictive analytics forecast demand to balance load and prevent outages.

✅ Automation, sensors, and meters enable dynamic, resilient distribution.

✅ Integrates solar and wind with demand response to cut emissions.

The city of Medicine Hat, Alberta, is taking bold steps toward enhancing its energy infrastructure and reducing electricity consumption with the help of innovative technology. Recently, several grant winners have been selected to improve the city's electricity grid distribution and leverage artificial intelligence (AI) to adapt to electricity demands while optimizing energy use. These projects promise to not only streamline energy delivery but also contribute to more sustainable practices by reducing energy waste.

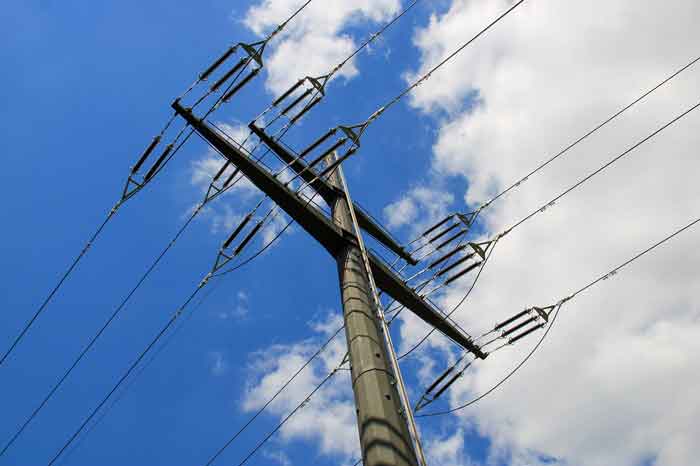

Advancing the Electricity Grid

Medicine Hat’s electricity grid is undergoing a significant transformation, thanks to a new set of initiatives funded by government grants that advance a smarter electricity infrastructure vision for the region. The city has long been known for its commitment to sustainable energy practices, and these new projects are part of that legacy. The winners of the grants aim to modernize the city’s electricity grid to make it more resilient, efficient, and adaptable to the changing demands of the future, aligning with macrogrid strategies adopted nationally.

At the core of these upgrades is the integration of smart grid technologies. A smart grid is a more advanced version of the traditional power grid, incorporating digital communications and real-time data to optimize the delivery and use of electricity. By connecting sensors, meters, and control systems across the grid, along with the integration of AI data centers where appropriate, the grid can detect and respond to changes in demand, adjust to faults or outages, and even integrate renewable energy sources more efficiently.

One of the key aspects of the grant-funded projects involves automating the grid. Automation allows for the dynamic adjustment of power distribution in response to changes in demand or supply, reducing the risk of blackouts or inefficiencies. For instance, if an area of the city experiences a surge in energy use, the grid can automatically reroute power from less-used areas or adjust the distribution to avoid overloading circuits. This kind of dynamic response is crucial for maintaining a stable and reliable electricity supply.

Moreover, the enhanced grid will be able to better incorporate renewable energy sources such as solar and wind power, reflecting British Columbia's clean-energy shift as well, which are increasingly important in Alberta’s energy mix. By utilizing a more flexible and responsive grid, Medicine Hat can make the most of renewable energy when it is available, reducing reliance on non-renewable sources.

Using AI to Reduce Energy Consumption

While improving the grid infrastructure is an essential first step, the real innovation comes in the form of using artificial intelligence (AI) to reduce energy consumption. Several of the grant winners are focused on developing AI-driven solutions that can predict energy demand patterns, optimize energy use in real-time, and encourage consumers to reduce unnecessary energy consumption.

AI can be used to analyze vast amounts of data from across the electricity grid, such as weather forecasts, historical energy usage, and real-time consumption data. This analysis can then be used to make predictions about future energy needs. For example, AI can predict when the demand for electricity will peak, allowing the grid operators to adjust supply ahead of time, ensuring a more efficient distribution of power. By predicting high-demand periods, AI can also assist in optimizing the use of renewable energy sources, ensuring that solar and wind power are utilized when they are most abundant.

In addition to grid management, AI can help consumers save energy by making smarter decisions about how and when to use electricity. For instance, AI-powered smart home devices can learn household routines and adjust heating, cooling, and appliance usage to reduce energy consumption without compromising comfort. By using data to optimize energy use, these technologies not only reduce costs for consumers but also decrease overall demand on the grid, leading to a more sustainable energy system.

The AI initiatives are also expected to assist businesses in reducing their carbon footprints. By using AI to monitor and optimize energy use, industrial and commercial enterprises can cut down on waste and reduce energy-related operational costs, while anticipating digital load growth signaled by an Alberta data centre agreement in the province. This has the potential to make Medicine Hat a more energy-efficient city, benefiting both residents and businesses alike.

A Sustainable Future

The integration of smart grid technology and AI-driven solutions is positioning Medicine Hat as a leader in sustainable energy practices. The city’s approach is focused not only on improving energy efficiency and reducing waste but also on making electricity consumption more manageable and adaptable in a rapidly changing world. These innovations are a crucial part of Medicine Hat's long-term strategy to reduce carbon emissions and meet climate goals while ensuring reliable and affordable energy for its residents.

In addition to the immediate benefits of these projects, the broader impact is likely to influence other municipalities across Canada, including insights from Toronto's electricity planning for rapid growth, and beyond. As the technology matures and proves successful, it could set a benchmark for other cities looking to modernize their energy grids and adopt sustainable, AI-driven solutions.

By investing in these forward-thinking technologies, Medicine Hat is not only future-proofing its energy infrastructure but also taking decisive steps toward a greener, more energy-efficient future. The collaboration between local government, technology providers, and the community marks a significant milestone in the city’s commitment to innovation and sustainability.

Related News