Conergy records first net profit in 5 years

GERMANY - Solar company Conergy plans to return to profit this year following a deep restructuring and a narrow escape from insolvency.

Once Europe's biggest solar company, Conergy agreed a debt-for-equity swap in December, which would give control to hedge funds Sothic Capital and York.

Conergy's has cash suffered by focusing on too many areas in the renewable energy sector and it was also hit in late 2008 by massive price decreases for products, hitting sales and margins.

"We're planning for a net profit," Chief Financial Officer Sebastian Biedenkopf said at the company's extraordinary general meeting EGM, adding the company also expected sales to increase.

According to Thomson Reuters I/B/E/S, 2011 net profit is expected to be 7.2 million euros US $9.95 million, Conergy's first positive bottom line since 2006.

Conergy had earlier posted a preliminary 2010 net loss of 42 million euros due to writedowns.

It refrained from giving an outlook for 2011, a critical year for the sector as the world's biggest market Germany is expected to shrink due to subsidy sector cuts.

German lawmakers a day earlier passed a law cutting solar power subsidies by up to 15 percent from this summer, six months earlier than originally planned, forcing Conergy along with industry peers such as Q-Cells and SolarWorld to expand abroad.

Should shareholders agree to the measure Conergy's debt-for-equity swap, the company's capital stock would be reduced by 88 percent while fresh equity of as much as 188 million euros would be raised, reducing its debt pile to about 135 million euros from a current 323 million.

"Such a debt level... opens up the possibility of actively pursuing strategic options such as cooperations or joint ventures again in order to benefit from future growth opportunities," Biedenkopf said.

He said he expected business to pick up in the spring after a typically weak start to the financial year, when cold weather make it harder to install solar modules on roofs.

"Even though the beginning of the year was rather muted — which was not unexpected — we expect the market and our business to revive in the spring."

Related News

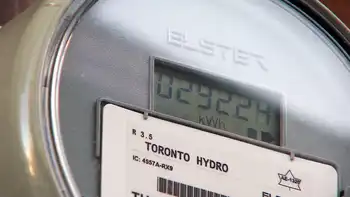

Federal government spends $11.8M for smart grid technology in Sault Ste. Marie

SAULT STE MARIE - PUC Distribution Inc. in Sault Ste. Marie is receiving $11.8 million from the federal government to invest in infrastructure.

The MP for the riding, Terry Sheehan, made the announcement on Monday.

The money will go to the utilities smart grid project.

"This smart grid project offers a glimpse into our clean energy future and represents a new wave of economic activity for the region," Sheehan said.

"Along with job creation, new industries will be attracted to a modern grid, all while helping the environment."

His office says the investment will allow the utility to reduce outages, provide more information to customers…