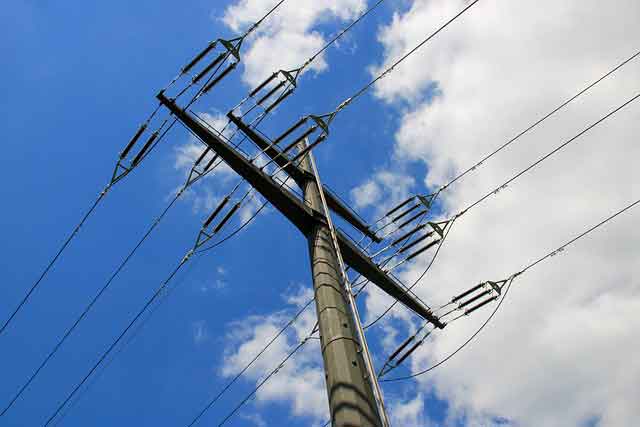

Utilities told to pay up for outage costs

By Detroit Free Press

NFPA 70e Training - Arc Flash

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

Groveland Township, for one, had at least seven reports to its fire department of lines down that it had to guard until DTE repair workers arrived.

"Babysitting these power lines is typically a big problem for us and much more so in violent storms like the one we just experienced," township Fire Chief Steve McGee said.

It's enough of an issue that the township — and a growing number of area municipalities — now charge utility companies for the services police and fire personnel provide during emergencies such as downed wires and natural gas leaks.

The shift has the potential to provide thousands of dollars of revenue for communities such as Royal Oak, Madison Heights, Ferndale, Waterford, White Lake Township and Groveland Township that already have adopted ordinances allowing such fees to be charged. And many others may follow suit.

DTE Energy and Consumers Energy officials argue that they pay huge amounts in property taxes each year on substations and service buildings and shouldn't have to pay additional fees.

"We're taxpayers in these communities, too," said DTE spokesman Scott Simons.

The fees vary from community to community. Ferndale, whose officials say their emergency personnel wait at the scene of 100 downed power lines and 30 gas leaks each year, can charge up to $250 an hour for a fire engine at the scene, in addition to an average of $40 per hour for each firefighter and police officer.

Royal Oak charges hourly fees ranging from almost $400 for a main engine at the scene to an average of $50 for each firefighter and police officer.

"Our goal is not about generating city revenue but about generating the appropriate response from the utility companies," Royal Oak Fire Chief Wil White said.

Ferndale Fire Chief Roger Schmidt insisted the goal is to get the utility companies to respond in a timely manner.

"On a normal day we've got eight to 10 people on duty," Schmidt said. "When you run into several problem situations the same day, you can get stretched thin really fast and then you have to call in off-duty people. I don't want to say it's not our problem, because it is, but it's their problem as well."

DTE Energy officials noted it pays $300,000 in property taxes annually to Ferndale and $1.2 million to Royal Oak.

"Naturally, safety is our highest priority, and we respond to every emergency as quickly as possible," DTE Energy spokesman Len Singer said. "However, we don't believe we should have to pay for emergency responses when power lines go down.... They're not safeguarding our lines, they're safeguarding the public."

DTE Energy's service area stretches from Monroe County to the tip of the Thumb, an area of 7,600 square miles with 2.2 million electric customers, Singer said. And with so much area to cover, he said, workers often cannot respond as quickly — particularly during wind and ice storms.

In those instances, Singer said, it is standard procedure to dispatch public safety teams consisting of everyday office personnel to secure a scene until service crews can arrive.

Consumers Energy, which provides gas and electric service to nearly 6 million people in Michigan, takes a similar stance. The Jackson-based utility said it paid $491,679 in property taxes to Royal Oak last year and $130,964 to Ferndale.

"While we appreciate the services provided by the police and fire departments in these kind of situations, we hope they recognize that we can't always respond as promptly as we would like during incidents such as a major storm," said Debra Dodd, a spokeswoman for Consumers Energy. "However, we are willing to reimburse them for reasonable costs for their response."

What can be charged and what actually is collected are two different things. Before last weekend's storm, Ferndale — which adopted its ordinance last spring — had billed DTE twice for downed lines. White Lake Township said it has used its ordinance less than a half-dozen times since adopting it three years ago. Madison Heights has yet to bill anyone.

Royal Oak, however, said it has submitted bills for more than $30,000 worth of services over the past two years.

"They've been known to drag their feet when it comes to paying up," White said.

Countering such claims, DTE spokesman Singer replied, "We have reimbursed communities for the emergency response ordinance when extraordinary circumstances warranted... although it's decidedly the exception."

As the two sides continue to debate the justification for such ordinances, some fire officials say there has been a noticeable reduction in the amount of time spent at emergency sites by police and fire departments.

"We've noticed a much quicker response time from the utility companies," White Lake Township Fire Chief Tony Maltese said. "And why not? Money is tight right now and they have to watch every nickel and dime just like we do."