Planning for Toronto?s Growing Electricity Needs

Arc Flash Training CSA Z462 - Electrical Safety Essentials

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

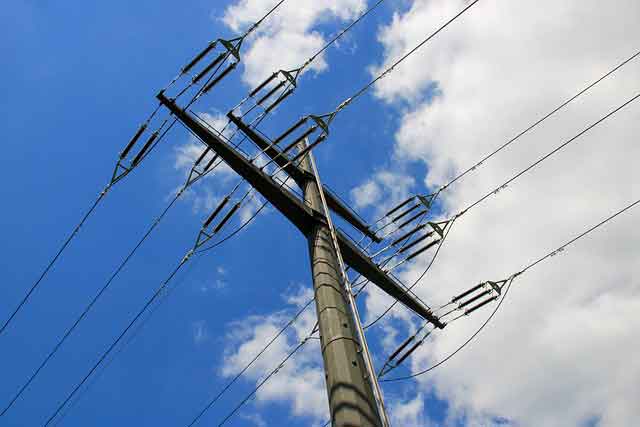

Toronto Grid Upgrade expands electricity capacity and reliability with new substations, upgraded transmission lines, and integrated renewable energy, supporting EV growth, sustainability goals, and resilient power for Toronto's growing residential and commercial sectors.

Key Points

A joint plan to boost grid capacity, add renewables, and improve reliability for Toronto's rising power demand.

✅ New substations and upgraded transmission lines increase capacity

✅ Integrates solar, wind, and storage for cleaner, reliable power

✅ Supports EV adoption, reduces outages, and future-proofs the grid

As Toronto's population and economy continue to expand, the surge in electricity demand in the city is also increasing rapidly. In response, the Ontario government, in partnership with the City of Toronto and various stakeholders, has launched an initiative to enhance the electricity infrastructure to meet future needs.

The Ontario Ministry of Energy and the City of Toronto are focusing on a multi-faceted approach that includes upgrades to existing power systems and the integration of renewable energy sources, as well as updated IoT cybersecurity standards for sector devices. This initiative is critical as Toronto looks towards a sustainable future, with projections indicating significant growth in both residential and commercial sectors.

Energy Minister Todd Smith highlighted the urgency of this project, stating, “With Toronto's growing population and dynamic economy, the need for reliable electricity cannot be overstated. We are committed to ensuring that our power systems are not only capable of meeting today's demands but are also future-proofed against the needs of tomorrow.”

The plan involves substantial investments in grid infrastructure to increase capacity and improve reliability. This includes the construction of new substations and the enhancement of old ones, along with the upgrading of transmission lines and exploration of macrogrids to strengthen reliability. These improvements are designed to reduce the frequency and severity of power outages while accommodating new developments and technologies such as electric vehicles, which are expected to place additional demands on the system.

Additionally, the Ontario government is exploring the potential for renewable energy sources, such as rooftop solar grids and wind, to be integrated into the city’s power grid. This shift towards green energy is part of a broader effort to reduce carbon emissions and promote environmental sustainability.

Toronto Mayor John Tory emphasized the collaborative nature of this initiative, stating, “This is a prime example of how collaboration between different levels of government and the private sector can lead to innovative solutions that benefit everyone. By enhancing our electricity infrastructure, we are not only improving the quality of life for our residents but also supporting Toronto's competitive edge as a global city.”

The project also includes a public engagement component, where citizens are encouraged to provide input on the planning and implementation phases. This participatory approach ensures that the solutions developed are in alignment with the needs and expectations of Toronto's diverse communities.

Experts agree that the timing of these upgrades is critical. As urban populations grow, the strain on infrastructure, especially in a powerhouse like Toronto, can lead to significant challenges. Proactive measures, such as those being implemented by Ontario and Toronto, and mirrored by British Columbia's clean energy shift underway on the west coast, are essential in avoiding potential crises and ensuring economic stability.

The success of this initiative could serve as a model for other cities facing similar challenges, highlighting the importance of forward-thinking and cooperation in urban planning and energy management. As Toronto moves forward with these ambitious plans, the eyes of the world, particularly other urban centers, will be watching and learning how to similarly tackle the dual challenges of growth and sustainability, with recent examples like London's newest electricity tunnel demonstrating large-scale grid upgrades.

This strategic approach to managing Toronto's electricity needs reflects a comprehensive understanding of the complexities involved in urban energy systems and a commitment to ensuring a resilient and sustainable future that aligns with Canada's net-zero grid by 2050 goals at the national level for all residents.