Ukraine Winter Energy Resilience focuses on energy security, grid repairs, renewable power, EU support, heating reliability, electricity imports, and conservation measures to stabilize infrastructure and protect households amid conflict and severe cold.

Key Points

A strategy to secure heat and power via repairs, renewables, imports, and conservation during wartime winter.

✅ Grid repairs and hardening of power plants and transmission lines

✅ Diversified supply: renewables, electricity imports, fuel reserves

✅ Public conservation to cut peak demand and safeguard essential services

As winter approaches, Ukraine is bracing for a challenging season, especially in the energy sector amid global energy instability and price pressures, which has been heavily impacted by the ongoing conflict with Russia. With the weather forecast predicting colder temperatures, the Ukrainian government is ramping up efforts to secure energy supplies and bolster infrastructure, aiming to ensure that citizens have access to heating and electricity during the harsh months ahead.

The Energy Landscape in Ukraine

The conflict has severely disrupted Ukraine’s energy infrastructure, leading to widespread damage and inefficiencies. Key facilities, including power plants and transmission lines, have been targeted amid energy ceasefire violations reported by both sides, resulting in significant energy shortages. As a response, the government has implemented a series of measures aimed at stabilizing the energy sector, ensuring that the nation can withstand the winter months.

One of the primary strategies has been the repair and reinforcement of energy infrastructure. Officials have prioritized critical facilities that are essential for electricity generation and distribution. Emergency repairs and upgrades are being carried out to restore functionality and improve resilience against potential attacks.

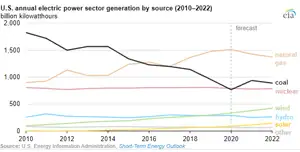

In addition to repairing existing infrastructure, Ukraine is actively seeking to diversify its energy sources. This includes increasing reliance on renewable energy, such as wind and solar, which can be less susceptible to disruption. The shift toward renewables not only enhances energy security and supports moving away from fossil fuels in line with Ukraine's long-term environmental goals.

International Support and Collaboration

Ukraine's challenges have not gone unnoticed on the international stage. Countries and organizations around the world have pledged energy security support to help Ukraine fortify its energy sector. This assistance includes financial aid, technical expertise, and the provision of materials needed for infrastructure repairs.

The European Union, in particular, has been a key ally, providing both immediate and long-term support to Ukraine's energy efforts. The EU's commitment to helping Ukraine transition to a more sustainable energy model, including steps toward ENTSO-E synchronization to bolster grid stability, is reflected in various initiatives aimed at increasing energy efficiency and integrating renewable sources.

Furthermore, international organizations have mobilized resources to assist in the restoration of damaged infrastructure. This collaboration not only enhances Ukraine's energy capabilities but also strengthens ties with global partners, fostering a sense of solidarity amidst the ongoing conflict.

Preparing for Winter Challenges

As temperatures drop, the demand for heating will surge, putting additional pressure on an already strained energy system. To address this, the Ukrainian government is urging citizens to prepare for potential shortages. Officials are promoting energy conservation measures, encouraging households to reduce consumption and use energy more efficiently.

Public awareness campaigns are being launched to educate citizens about the importance of energy saving and the steps they can take to minimize their energy use and prevent outages during peak demand. These initiatives aim to foster a collective sense of responsibility as the nation braces for the winter ahead.

In addition to conservation efforts, the government is exploring alternative energy supplies. This includes negotiating with neighboring countries for electricity imports and enhancing domestic production where feasible. By securing a diverse range of energy sources, Ukraine aims to mitigate the risk of shortages and ensure that essential services remain operational.

The Role of Resilience and Innovation

Despite the challenges, the resilience of the Ukrainian people and their commitment to overcoming adversity shine through. Communities are coming together to support one another, sharing resources and information to help navigate the difficulties of winter.

Innovative solutions are also emerging as part of the response to the energy crisis. Local initiatives aimed at promoting energy efficiency and the use of alternative energy sources are gaining traction. From community-led solar projects to energy-efficient building practices, Ukrainians are finding ways to adapt and thrive even in the face of uncertainty.

Looking Ahead

As Ukraine prepares for the winter months, the focus remains on ensuring energy security and maintaining the functionality of critical infrastructure. While challenges loom, the collective efforts of the government, international partners, and citizens demonstrate a strong commitment to resilience and adaptation.

In conclusion, the upcoming winter presents significant challenges for Ukraine's energy sector, yet the nation's determination to secure its energy future remains unwavering. With ongoing repairs, international support, and community innovation, Ukraine is working diligently to navigate the complexities of this winter, aiming to emerge stronger and more resilient in the face of adversity. The resilience shown today will be crucial as the country continues to confront the ongoing impacts of conflict and seeks to build a sustainable future.

Related News