New England Grid Reform Initiative aligns governors with ISO New England to reshape market design, boost grid reliability, accelerate renewable energy and offshore wind, explore carbon pricing and forward clean energy markets, and bolster accountability.

Key Points

Five states aim to reform ISO New England markets, prioritize renewables and reliability, and test carbon pricing.

✅ Governors seek market design aligned with clean energy mandates

✅ ISO-NE accountability and stakeholder engagement prioritized

✅ Explore carbon pricing and forward clean energy market options

Weeks after initiating a broad overhaul of utility regulation within its borders, Connecticut has recruited four New England states, as Maine debates a 145-mile transmission line project to rework the regional grid that is overseen by ISO New England, the independent system operator charged with ensuring a reliable supply of electricity from power plants.

In a written statement Thursday morning, Gov. Ned Lamont said the current structure “has actively hindered” states’ efforts to phase out polluting power plants in favor of renewable sources like wind turbines and solar panels, while increasing costs “to fix market design failures” in his words. Lamont’s energy policy chief Katie Dykes has emerged as a vocal critic of ISO New England’s structure and priorities, in her role as commissioner of the Connecticut Department of Energy and Environmental Protection.

“When Connecticut opted to deregulate our electricity market, we wanted the benefits of competition — to achieve lower-cost energy, compatible with meeting our clean-energy goals,” Dykes said in a telephone interview Thursday afternoon. “We have a partner [in] ISO New England, to manage this grid and design a market that is not thwarting our clean-energy goals, but achieving them; and not ignoring consumers’ concerns. ... That’s really what we are looking to do — reclaim the benefits of competition and regional cooperation.”

Lamont and his counterparts in Massachusetts, Rhode Island, Vermont and Maine plan to release a “vision document” in their words on Friday through the New England States Committee on Electricity, after New Hampshire rejected a Quebec-Massachusetts transmission proposal that sought to import Canadian hydropower.

The initial documents made no mention of New Hampshire, which likewise obtains electricity through the wholesale markets managed by ISO New England and has seen clashes over the Northern Pass hydropower project in recent years; and whose Seabrook Station is one two nuclear power plants in New England alongside Dominion Energy’s Millstone Power Station in Waterford. Gov. Chris Sununu’s office did not respond immediately to a query on why New Hampshire is not participating.

Connecticut and the four other states outlined a few broad goals that they will hone over the coming months. Those include creating a better market structure and planning process supporting the conversion to renewables; improving grid reliability, with measures such as an emergency fuel stock program considered; and increasing the accountability of ISO New England to the states and by extension their ratepayer households and businesses.

ISO New England spokesperson Matt Kakley indicated the Holyoke, Mass.-based nonprofit will “engage with the states and our stakeholders” on the governors’ proposal, in an email response to a query. He did not elaborate on any immediate opportunities or challenges inherent in the governors’ proposal.

“Maintaining reliable, competitively-priced electricity through the clean energy transition will require broad collaboration,” Kakley stated. “The common vision of the New England governors will play an important role in the discussions currently underway on the future of the grid.”

Renewable revolution

ISO New England launched operations in 1999, running auctions through which power plant operators bid to supply electricity, including against long-term projections for future needs that can only be met through the construction or installation of new generation capacity.

ISO New England falls under the jurisdiction of the Federal Energy Regulatory Commission rather than the states whose electricity supplies it is tasked with ensuring. That has led to pointed criticism from Dykes and Connecticut legislators that ISO New England is out of touch with the state’s push to switch to renewable sources of electricity.

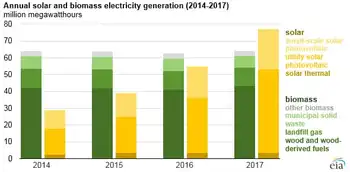

Entering October, ISO New England published an updated outlook that revealed 60 percent of proposed power generators in the region’s future “queue” are wind farms, primarily offshore installations like the proposed Park City Wind project of Avangrid and Revolution Wind from Eversource. But Dykes recently criticized as unnecessary an NTE Energy plant approved already by ISO New England for eastern Connecticut, which will be fueled by natural gas if all other regulatory approvals are granted.

The six New England states participate in the Regional Greenhouse Gas Initiative that caps carbon emissions by individual power plants, while allowing them to purchase unused allowances from each other with that revenue funneled to the states to support renewable energy and conservation programs. FERC is now considering the concept of carbon pricing, which would levy a tax on power plants based on their emissions, and it also faces pressure to act on aggregated DERs from lawmakers.

ISO New England is investigating the concepts of net carbon pricing and a “forward clean energy market” that would borrow elements of the existing forward capacity market, but designed to meet individual state objectives for the percentage of renewable power they want generated while ensuring adequate electricity is in place when weather does not cooperate.

The Connecticut Public Utilities Regulatory Authority is collecting on its own initiative industry input on modernization proposals, as New York regulators open a formal review of retail energy markets for comparison, that would add up to hundreds of millions of dollars, including utility-scale batteries to store power generated by offshore wind farms and solar arrays; and “smart” meters in homes and businesses to help electricity customers better manage their power use.

The New England Power Pool serves as a central forum for plant operators, commercial users and others like the Connecticut Office of Consumer Counsel, amid Massachusetts solar demand charge debates that affect distributed generation policy, with NEPOOL’s chair stating Thursday morning the group was still reviewing the governors’ announcement.

“NEPOOL has been engaged this year in meetings ... exploring the transition to a future grid in New England and potential pathways forward to support that transition,” stated Nancy Chafetz, chair of NEPOOL, in an email.

Connecticut’s issues with ISO New England boiled over this summer on the heels of a power-purchase agreement between Millstone owner Dominion and transmission grid operators Eversource and United Illuminating, which contributed to a sharp increase in customer bills.

A few weeks ago, Lamont signed into law a “Take Back the Grid” act that allows the Connecticut Public Utilities Regulatory Authority to factor in Eversource’s and Avangrid subsidiary United Illuminating’s past performance in maintaining electric reliability, in addition to any future needs for revenue based on needed upgrades. The law included an element for Connecticut to initiate a study of ISO New England’s role.

Eversource and Avangrid have voiced support for the switch to “performance-based” regulation in Connecticut. Eversource spokesperson Mitch Gross on Thursday cited the company’s view that any changes to the operation of New England’s wholesale power markets should occur within the existing ISO New England structure.

“We also recommend any examination of potential alternatives includes a thorough evaluation that ensures unfair costs would not be imposed on customers,” Gross stated in an email.

In a statement forwarded by Avangrid spokesperson Ed Crowder, the United Illuminating parent indicated it intends to have “a voice in this process” with the goal of continued grid reliability amid increased adoption of clean energy sources.

Related News