China might give hybrids a big push

By Globe and Mail

Protective Relay Training - Basic

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

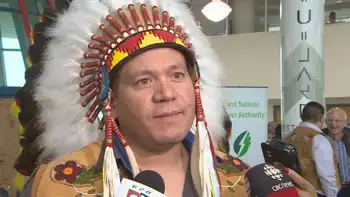

"Shanghai General Motors, our joint venture in China, just announced that this year they are going to roll out the first hybrid in volume production of Buick Lacrosse in China; it's a Buick Lacrosse hybrid," he said while attending a recent conference in Vancouver (the Lacrosse model is sold as the Allure in Canada).

"The attractiveness of this is that the technology is very affordable. However, it achieves over a 15-per-cent improvement in fuel economy. I personally believe, given the driving stop-and-go conditions in bigger cities in China, some of the hybrid concepts could work very well."

For now, Chen says no manufacturer is producing hybrids in large numbers in China, but the government is seriously considering incentives to encourage consumers to buy hybrids.

"Today, the Chinese consumer pays a 10-per-cent purchase tax, and they may get a break on the purchase tax if they buy a hybrid vehicle," he says. Manufacturers may also receive tax breaks for selling hybrids.

Chen predicts that in the next five years, more and more hybrids will be sold in China.

"China is looking at leapfrogging the world in terms of technology to make the entire auto industry more sustainable," he says.

"There are 1.3 billion people. If the market expands to the world average level of car ownership, 10 or 11 per cent, that's 100 million people driving cars.

"China cannot do business as usual. The world doesn't have the energy to support that," he says, adding, "Ultimately, if we can drive a car with electricity, supplied with energy from hydro, nuclear, and renewable sources - and if battery technology can improve enough - that brings a different outlook to the auto market.

"The batteries can be charged by various sources, such as an engine used as a generator, or a fuel-cell stack, or charged off a wall plug.

"It's going to take a lot of collective effort. Maybe not in the next five years, but we'll find a solution."