Portsmouth wind turbine paying dividends already

By Providence Journal

Protective Relay Training - Basic

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

For the first 50 days’ operation, the municipally owned wind tower overlooking Portsmouth High School generated 481,950 kilowatt hours of electricity — about a tenth of the annual consumption of municipal and school facilities.

As of noon May 6, all the pennies have added up to a value of $69,882.75, either in savings on the townÂ’s electric bill or cash receipts.

Overall, the output of the turbine is on track with projections, says Gary Gump, one of several volunteers who shepherded the windmill from dream to reality over the last five years.

Finance Director David P. Faucher sums up the economic impact: in the fiscal year beginning July 1, the turbine is expected to cut a quarter off its $433,000 electric bill, pay the annual installment on bonds used for its construction — $238,643 — and generate an additional $238,000 in revenue to offset expenses in either municipal government or the schools.

Governor Carcieri and other dignitaries will gather to formally inaugurate the wind tower, which started producing power for National Grid on March 18.

Inside the hollow tower, a ladder leads to a point 213 feet above the ground. A technician regularly climbs the ladder to inspect the turbine.

The technician wears a harness clipped to a cable running in tandem with the ladder. Invariably, he pauses to rest on platforms set at 80 and 160 feet off the ground, before reaching an oblong aerie.

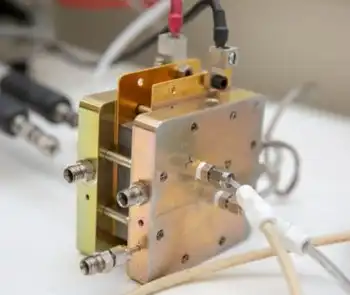

The three blades — each 123 feet long — cup the wind like sails. As the blades move, they turn a shaft that is connected to a gearbox. Inside the box, one set of gears meshes with another, changing the motion from a slow rotation to a high-speed hum.

Next, the energy moves through a whirring shaft that excites electrons along a magnetic field, generating electricity.

The power runs through a high-voltage line back down the tower to a transformer installed next to the base. There the current changes its characteristics so that the electricity can be used by National Grid.

National Grid credits the town for the electricity it produces, reducing its electric bill by 15.4 cents for every kilowatt hour generated, according to Gump, the citizen volunteer with the Portsmouth Economic Development Committee.

In addition, the town periodically gets checks from PeopleÂ’s Power & Light, a nonprofit organization that aims to provide incentives to expand the number of alternative energy producers and lower the cost.

Portsmouth gets the equivalent of 4 cents a kilowatt hour for what amounts to “bragging rights” sold to consumers. They sign up to pay a small premium on their electric bills to be able to say they get their energy from renewable sources, according to PP&L spokeswoman Karina Lutz.

The average household pays about $12 a month, a sum that is fully tax deductible, she said.

At any given time, town officials can keep track of exactly whatÂ’s going on in the wind turbine, thanks to the software on two dedicated computer terminals, one in Town Hall, the other in the Fire Department station.

The manufacturer of the turbine, AAER, has a third hookup, in its offices in Canada, where it monitors the turbine.

Town officials are often asked why the blades on the tower at Portsmouth High stand still while the ones across town at Portsmouth Abbey turn in the wind.

Sometimes, they say, the manufacturer has the turbine off for fine tuning.

But other times, they say, there is not enough wind to generate electricity. The AbbeyÂ’s wind turbine, installed three years ago, turns regardless.

But a design enhancement on the town’s turbine — more than twice the size of the Abbey’s machine — saves wear and tear on the parts by turning it off when the wind speed falls below 6 mph, Gump said.