Waukesha plans $70 million expansion

The $70 million expansion, partly funded by $25 million in tax credits, is scheduled to start this year and take 18 months to complete. It will result in the addition of 100 permanent, full-time jobs beginning in late 2011 and about 250 jobs in three years, according to the company.

"We will start the design and engineering of the facility right away," said Tom Brockley, company president.

About 60 of the new jobs will be salaried, including engineers and supervisors. Hourly wages for the production employees would average $18.13, according to a company memorandum filed with the city of Waukesha.

Currently, the company has 520 employees in Waukesha and 320 at other locations, including a North Carolina factory.

The expansion will add 140,000 square feet to the local factory, at 400 S. Prairie Ave., increasing its size about 50.

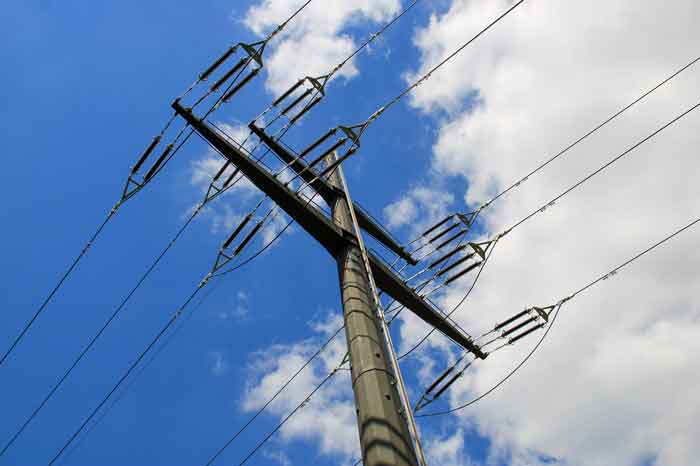

It will allow Waukesha Electric to build some of the largest power transformers available, including units rated at 500 megavolt-amperes and weighing hundreds of tons.

"What limits us today is crane capacity and height," Brockley said. "And we will need much bigger winding machines that wind the coils" used on transformers.

For more than 40 years, Waukesha Electric has specialized in building medium-size power transformers used by utility companies and independent power producers. It is a division of SPX Corp., a Charlotte, North Carolina, manufacturer with an eclectic product mix that also includes food processing equipment and hand-held diagnostic tools used by car mechanics.

The cost of the expansion will be partly offset by $4 million in tax credits from the state Department of Commerce, $12 million in federal tax credits, and $9 million in Waukesha tax increment financing.

"Without it, I don't think we would be doing this," Brockley said of the government assistance.

The demand for power transformers has been down in the recession.

SPX recently reported a 9.4 drop in quarterly profit on weak demand for transformers. About 40 of its annual revenue is from power and energy markets.

The long-term outlook remains bullish as rising demand for electricity, coupled with an aging power grid, will result in the need for more transformers and other power generation equipment.

Many transformers in use now are more than 30 years old.

"It's meaningful because after 25 years of use the risk for failure begins to increase rapidly," Chris Kearney, SPX chairman, president and CEO, said in an investor conference broadcast on the Internet.

"Government agencies have implemented regulations in recent years that penalize utilities for power interruptions and failure of service. The penalties can exceed the cost of a transformer," Kearney said.

Waukesha Electric estimates the market for large transformers is about 500 to 600 units per year in the United States, with units selling for between $2 million and $10 million each.

About 80 of the large transformers sold in the U.S. are imported from Europe and Korea.

Waukesha Electric expects to ramp up production gradually, getting a slice of the North American market and building about 50 of the large units a year. It will begin hiring next April.

Given the cost of shipping something so large, the company should have a price advantage over foreign suppliers. It also could use the factory expansion to increase production of medium-size transformers.

SPX had a transformer factory in California but closed it early in the decade. Then the power blackouts in 2003 showed a need for more power generation equipment, and the Waukesha Electric factory was expanded.

Coming out of the recent recession, "We think now is a pretty good time for us to make this investment," Kearney said.

Related News

Yet another Irish electricity provider is increasing its prices

DUBLIN - ELECTRIC IRELAND has announced that it will increase its household electricity prices by 4% from 1 February 2018.

This comes just a week after both Bord Gáis Energy and SSE Airtricity announced increases in their gas and electricity prices.

Electric Ireland has said that the electricity price increase is unavoidable due to the rising wholesale cost of electricity.

The electricity provider said it has no plans to increase residential gas prices at the moment.

Commenting on the latest announcement, Eoin Clarke, managing director of Switcher.ie, said: “This is the third largest energy supplier to announce a price increase…