Green tech bubble concerns grow

By Reuters

Protective Relay Training - Basic

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

The recent credit crisis has made investors cautious and more aware of risks that can arise from crowded investment positions, according to the survey, carried out by tax and accounting services firm Rothstein Kass and released.

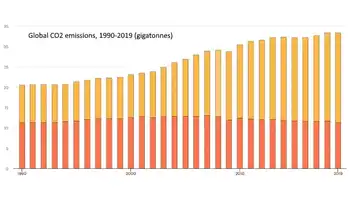

Green energy is the sector most likely to produce the next investment bubble, the survey said, with 24 percent of those surveyed highlighting it. Commodities were the second most likely, followed by gold and then financial services.

The respondents answered the questions in January, prior to recent falls in the gold price. The metal, as of May 17, is about $100 below its record highs above $1,575 an ounce set earlier this month.

"I think lot of people are jumping into green and cleantech figuring it's the next place to make money," said Thomas Angell, principal-in-charge of the Private Equity Practice at Rothstein Kass. "For the right technology... there's obviously a price to be paid."

Green energy can include power sources including solar, wind, geothermal and others that have a much lower pollution or carbon footprint than fossil fuels. These are among the fastest growing sources of energy but remain tiny compared with traditional coal, oil and natural gas.

Cleantech companies aim to use technology to reduce pollutants and waste generated by industries such as manufacturing, energy, construction and transportation.

For new investments, private equity firms are most keen on increasing their investments in technology, healthcare and cleantech, the survey of 207 private equity fund managers said. Most polled were small and mid-sized funds but the survey included some mega-funds.

Private equity firms have been benefiting from an improving economy and rising stock market valuations and have seen the value of their portfolios increase. They have also taken advantage of a rebound in M&A and stronger IPO markets to exit some of their investments.

However, while debt markets have recovered since the credit crisis — allowing private equity firms to strike larger deals — valuations of assets have increased, making deals hard to strike. Funds, which were left with a lot of 'dry powder' — or capital available to invest, have in some cases struggled to invest that money.

"When the market crashed and everything stopped, there was a lot of dry powder in a lot of private equity funds," said Angell. "They probably figured they could make some great deals on some of these businesses."

However, what ended up happening was that unless a business was in dire need of clinching a sale, sellers "pulled off the market," Angell said.

"So where you would have thought there may have been some good deals going on, nothing happened for a while," he said.

Private equity managers were roughly split on whether firms would increasingly strike leveraged buyout deals, and about half polled thought buyout firms would increasingly club together on deals, according to the survey.

More than 70 percent of respondents said they expect higher deal prices in 2011 as compared with 2010.

Some private equity firms have struggled since the credit crisis to raise money, as investors in their funds have had less available capital to invest.

Nearly 50 percent of the private equity managers that participated in the survey plan to raise capital in 2011, Rothstein Kass said.

The survey said nearly 80 percent of private equity fund managers expect pressure to reduce fees, an increase from 65 percent in Rothstein Kass' survey a year earlier.