What can the U.S. learn from ChinaÂ’s energy policy?

By Canada Free Press

Arc Flash Training - CSA Z462 Electrical Safety

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

ChinaÂ’s economy is growing at a rate of 9 percent per year, and forecasts have its fast pace of economic growth continuing, though at a slightly lower rate. Eager to bring more of its citizens out of poverty, China will not let energy be a bottleneck for such growth.

Because it has limited domestic oil and gas resources, China is investing globally to ensure supply. The worldÂ’s most populous country is also expanding its coal-fired electricity capacity at breakneck speed and making a major commitment to nuclear energy.

In smaller quantities, and under international pressure from the environmental community, China is also constructing solar- and wind-powered generating facilities, to the point that 30 percent of its wind capacity cannot be supported by its electric grid. Yet even with all these other technologies, coal will remain ChinaÂ’s mainstay for a very long time since coal is its most abundant and least expensive resource.

All this is happening in a developing country that learns from others, and quickly outperforms them by manufacturing the same materials at significantly less cost, thus increasing its export market. It is also a country where there is a lot less red tape: regulations, legal delays, and financing issues do not stand in the way of its energy construction progress.

China currently gets 70 percent of its energy from coal and is expected to retain this fuel as its major source of energy at least through the next several decades. China ranks third in the world in recoverable coal reserves, after the U.S. and Russia. Its annual coal production and consumption is the highest in the world, more than twice that of the U.S.

Both ChinaÂ’s generating sector and its industrial sector rely heavily on coal, with 79 percent of its electric generation being coal-fired. The Energy information Administration (EIA) expects that 75 percent of ChinaÂ’s electric generation will still be coal-fired in 2030.

That EIA forecast expects 600 additional gigawatts of coal-fired capacity to be built in China between 2006, the most recent year of reliable data, and 2030. That equates to 50 plants a year of 500 megawatt (MW) capacity, or one coal plant coming on line each and every week for 24 years.

From current reports, China is meeting this goal by planning to build 500 coal-fired plants over the next ten years. That means: every week to 10 days, China will open another coal-fired power plant that is big enough to serve all the households in Dallas or San Diego.

Not only is China building coal-fired plants to increase its generating capacity; it is building them to back-up wind power when the wind doesnÂ’t blow or when the grid is inadequate to handle the wind capacity. Last year, as much as 30 percent of ChinaÂ’s wind power was not connected to the grid.

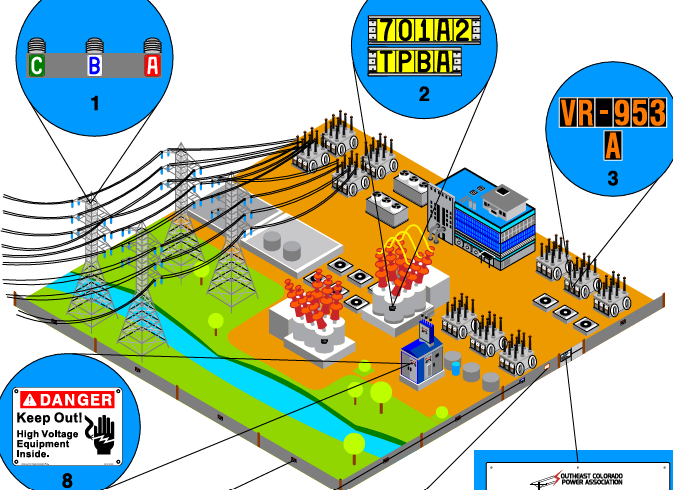

Adding to the problem is poor connectivity between regional transmission networks, which makes it difficult to move surplus power from one part of the country to another and thus requires each region to have sufficient reserve capacity.

Even with these problems, China has a goal to produce 15 percent of its energy from renewables by 2020. To help meet this goal, China is planning to build the worldÂ’s largest wind farm in the northwest part of the country. The plan is for 5 gigawatts in 2010, expanding to 20 gigawatts in 2020, at a cost of $1 million per megawatt, or $1,000 per kilowatt, about half the cost of an onshore wind unit in the U.S., according to the Energy Information Administration.

While China is manufacturing wind turbines for domestic use, few of its wind turbines are currently being exported. But that may soon change if the U.S. allows a consortium of Chinese and American companies to build a 600-megawatt wind farm in West Texas, using turbines manufactured in China.

One-third of the wind farmÂ’s funding will be from federal stimulus money and about 330 jobs will be created in the U.S., mostly temporary construction jobs. The labor-intensive work of building the turbines will also create thousands of jobs in China. GE will provide the gearboxes of the turbines, but they too will be made in China.

GE, a major U.S. wind turbine producer, already owns three facilities in China that produce turbine components. And GE is planning a factory in Vietnam that will employ 500 local workers and export 10,000 tons of components to GE Energy assembly plants around the world.

China leads the world in solar cell manufacture, although 95 percent of its production is exported. Currently, China itself generates very little electricity from solar power. At the end of 2008, about 0.01 percent of its grid-connected electric generating capacity was from solar.

However, in September, Arizona-based First Solar signed a deal to build the worldÂ’s largest solar farm in China by 2019, which will supply power to 3 million homes.

Realizing that the U.S. may be a good market for solar, ChinaÂ’s Suntech, the worldÂ’s largest supplier of solar panels, announced plans to build a solar manufacturing plant in Phoenix, Arizona, with production beginning next year. Arizona was chosen because its Renewable Energy Standard requires that 15 percent of the stateÂ’s electricity generation be supplied from renewable power by 2025 and because Arizona favors distributed generation, whereby power is provided locally for homes or businesses.

SuntechÂ’s factory will create finished panels from subcomponents that will be manufactured in the companyÂ’s Chinese facilities. According to Suntech, locating the assembly in the U.S. will lower delivery time and costs, as well as reduce the overall carbon footprint of getting finished panels to U.S. customers.

Because of Chinese and other Asian competition, the cost of solar panels dropped 50 percent in the past 18 months. Due to lower operating costs in China, a U.S.-based firm, Evergreen Solar, after receiving over $58 million in incentives from the state of Massachusetts, is moving its assembly plant to China.

(In 2008, MassachusettsÂ’s industrial electricity prices were 115 percent higher than those of Arizona. Industrial electricity prices in Massachusetts are lower in 2009, making the differential in prices through August 2009 only 69 percent.)

The push to get China into the solar power market seems to have some environmental consequences.

China is a major worldwide producer of polysilicon — the key component of sunlight capturing wafers. The manufacturing of polysilicon, however, produces a highly toxic substance, silicon tetrachloride, which can be recycled back into the production cycle. In China, however, many factories are dumping the waste product because of the high investment costs and time required for the recycling process, and because of the enormous energy consumption needed to heat the substance to more than 1800 degrees Fahrenheit. People close to the sites where the substance is being dumped are complaining of illness, crop failures, acrid air, and dead fields. But owing to the shortage of polysilicon, the Chinese Government is willing to overlook these complaints.

China is also building nuclear power plants, with 20 nuclear reactors under construction and more starting construction this year. Four AP 1000 reactors are under construction at 2 different sites: Haiyang and Sanmen. These are the same reactors that the U.S. Nuclear Regulatory Commission (NRC) has ruled need additional analysis, testing, or design modifications of the shield building to ensure compliance with NRC requirements.

China expects to achieve a total nuclear capacity of 60 gigawatts by 2020, and 120 to 160 gigawatts by 2030, surpassing the total nuclear capacity of the United States.

China is not well-endowed with natural gas, having only 1.3 percent of the worldÂ’s reserves. Nonetheless, it is expected to build an additional 23 gigawatts of gas-fired electric generating capacity by 2030, almost doubling its gas-fired capacity, according to the EIA. To fuel these generators, China will need to continue its dependence on natural gas imports, which will provide one-third of its total natural gas consumption by 2030.

China opened its first LNG regasification facility in 2006 at Guangdong, and 2 others are planned to open this year. The first imports of natural gas into China by pipeline are expected in 2011, via a new pipeline running from Turkmenistan through Kazakhstan.

China is on a fast track to bring online new generating units using coal, nuclear, solar, and wind power, which will allow its economy to continue to grow. However, because China is endowed with a sizable amount of coal resources and because coal is still the cheapest energy source in China, coal-fired generating additions will far outpace those of other technologies.

“No matter how much renewable or nuclear is in the mix, coal will remain the dominant power source,” said Ashok Bhargava, a China energy expert at the Asian Development Bank in Manila. By continuing to rely heavily on currently available coal technology, China will remain the number one emitter of carbon dioxide, almost doubling its carbon dioxide emissions by 2030, according to EIA’s forecast.

The U.S., on the other hand, has made it difficult to build generating plants in this country. Prospects of cap-and-trade legislation and reviews and re-reviews by the Environmental Protection Agency have slowed the construction of new coal-fired plants.

NRC requirements, financing difficulties, and slow fulfillment of the nuclear provisions of the Energy Policy Act of 2005 have slowed the construction of new nuclear power reactors. Even renewable energy projects have been halted by “not in my back yard” (NIMBY) protesters. They have blocked energy projects by organizing local opposition, changing zoning laws, opposing permits, filing lawsuits, and bleeding projects dry of their financing.

Without reasonably priced energy, it will be difficult to achieve high levels of economic growth, and U.S. industry will just move offshore where energy is more affordable.