High Rates Inflate OPG Profits

TORONTO -- - Hot weather and high prices for electricity this summer, and a special gain, helped more than double net profits despite slightly lower revenues at Ontario Power Generation Inc. (OPG), the dominant power generator of the province.

OPG, the giant publicly owned utility and spinoff of the former Ontario Hydro, said it earned $215 million, or 84 cents per share, in the three months ended Sept. 30, at a time of unseasonably high weather than boosted power demand for air conditioners and sent consumer electricity bills soaring. Revenue fell slightly to $1.5 billion from $1.55 billion last year.

"OPG's third quarter earnings reflect open market prices for the summer period and the impact of warmer than normal weather," the power producer said in a statement.

Peak demand in Ontario reached record levels during the third quarter, with a new peak of 25,414 megawatts set Aug. 13.

The government owned utility also cited a "favourable generation mix" of higher nuclear and hydroelectric generation for its strong earnings.

OPG stressed in a statement that under its government-driven mandate, it is ordered to provide consumers with rebates if the average price of power tops 3.8 cents a kilowatt hour over a year. OPG is also mandated to reduce its share of generating capacity to 35 per cent from almost 70 per cent within 10 years. Critics have said the utility should make such divestitures within a quicker timeframe.

The utility did have a gain in the third quarter from the sale of four hydroelectric stations on the Mississagi River, east of Sault Ste. Marie. The buyer was an income fund 50 per cent owned by Brascan Power Corp., one of Canada's biggest private power producers.

Four provincial properties on the block are the coal-fired Lakeview station in Mississauga; the Lennox station near Kingston; the Atikokan generating plant in northwestern Ontario; and a Thunder Bay operation.

OPG said it also had increased expenditures related to Pickering A, its nuclear power plant east of Toronto that was taken out of service in 1997 because of serious reliability problems and safety concerns. It was due back online this year at a cost of about $800 million but reports suggest it may not reopen before 2006 at a total cost of more than $3 billion.

Related News

Canada's nationwide climate success — electricity

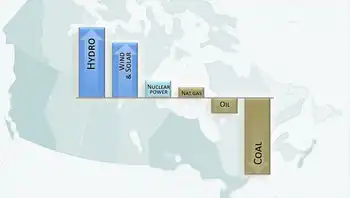

OTTAWA - Canada Clean Electricity leads decarbonization, slashing power-sector emissions through coal phase-out, renewables like hydro, wind, and solar, and nuclear. Provinces cut carbon intensity, enabling electrification of transport and buildings toward net-zero goals.

Key Points

Canada Clean Electricity is the shift to low-emission power by phasing out coal and scaling renewables and nuclear.

✅ 38% cut in electricity emissions since 2005; 84% fossil-free power.

✅ Provinces lead coal phase-out; carbon intensity plummets.

✅ Enables EVs, heat pumps, and building electrification.

It's our country’s one big climate success so far.

"All across Canada, electricity generation has been getting much…