County puts plug-in Prius to the test

The modifications on these fleet cars arenÂ’t designed to make them faster; theyÂ’re intended to increase the time they run on electricity instead of gas.

State and federal officials are measuring every inch of the carsÂ’ performance to judge how practical they could be on a large scale.

“The technology works and it’s reliable,” Snohomish County fleet manager Allen Mitchell said. “It isn’t the total answer, but it’s part of the answer.”

The experiment currently includes 228 vehicles in the U.S. and Canada. Washington, with 34 cars, is the second largest U.S. market after California, with 44.

Snohomish County is among 10 local governments in the program. The conversions on its two cars were done late last year at Wenatchee Valley College at a cost of $11,000 each to the county.

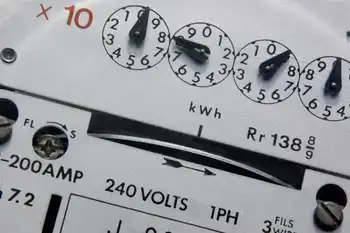

The resulting car looks like a normal Prius except for a plug on the rear bumper and magnetic decals boasting of “100+” mpg. Extra batteries in the trunk take up space normally occupied by a spare tire. The cars plug into standard 120-volt outlets and can recharge an empty battery in about five-and-a-half hours.

Plug-in hybrid electric vehicles could have a long road to travel before they prove cost-effective. Though they can sip fuel at a rate of 100 mpg at cruising speed, the average mileage under realistic conditions is closer to 50 mpg, Mitchell said, compared to about 40 mpg for a standard Prius.

That translates into about 4.1 cents per mile for a plug-in hybrid versus 4.7 cents for a normal Prius, he said. At that rate, it would save about $630 over 105,000 miles — the minimum replacement mileage for most county vehicles — compared to a regular Prius.

Those comparisons miss the point, say county, state and federal officials involved in the project. In part, thatÂ’s because the converted Priuses are thought to be more expensive and less efficient than production vehicles expected to hit the market in the next year or so.

“It’s a stepping stone to production vehicles,” said John Smart, a vehicle testing engineer working with the U.S. Department of Energy’s Advanced Vehicle Testing Activity at the Idaho National Laboratory. “Just about every single major automaker is announcing that they’re going to release either a plug-in hybrid electric or an electric vehicle within the next few years.”

Smart added other benefits besides costs: less pollution and using locally generated energy.

Tim Stearns, senior energy policy specialist at Washington stateÂ’s Department of Commerce, the agency heading the state pilot program, said that nobody expects the plug-in Priuses to be a miracle solution, or even save money in the short term.

“The idea that there are instant solutions and that they’re immediately less expensive is just an unrealistic hope,” Stearns said.

The state and federal projects complement other efforts to wean local fleets off conventional fuels.

About 70 percent of Snohomish CountyÂ’s diesel vehicles already run on biodiesel. The county also won a recent $1.1 million federal grant to pay for solar-powered recharging stalls for electric cars and money to offset buying more hybrids as well as fuel tanks for storing ethanol and biodiesel.

During the past eight years, Everett has purchased 36 vehicles that donÂ’t run on gasoline, from propane-powered forklifts to an electric boat, Ford Escape sport utility vehicles and Prius hybrids, city spokeswoman Kate Reardon said.

The Snohomish County Public Utility District would consider buying the upcoming all-electric Nissan Leaf car, spokesman Neil Neroutsos said. At the same time, the PUD is studying how to meet the power demands of electric cars on the electrical grid, since each is the equivalent of adding a large appliance such as a clothes dryer or a large plasma television set.

Related News

Alberta's Last Coal Plant Closes, Embracing Clean Energy

ALBERTA - The closure of the Genesee Generating Station on September 30, 2023, marked a significant milestone in Alberta's energy history. The Genesee, located near Calgary, was the province's last remaining coal-fired power plant. Its closure represents the culmination of a multi-year effort to transition Alberta's electricity sector away from coal and towards cleaner sources of energy.

For decades, coal was the backbone of Alberta's electricity grid. Coal-fired plants were reliable and relatively inexpensive to operate. However, coal also has a significant environmental impact. The burning of coal releases greenhouse gases, including carbon dioxide, a major contributor to climate change.…