A year ago: Utility trying to buy Constellation Energy is object of respect, hate in booming Florida

FORT LAUDERDALE, FLORIDA - In the eyes of many consumers and politicians, this city's gentrified Rio Vista neighborhood represents the best and worst of Florida Power & Light's potential as a merger partner for Baltimore's Constellation Energy Group Inc.

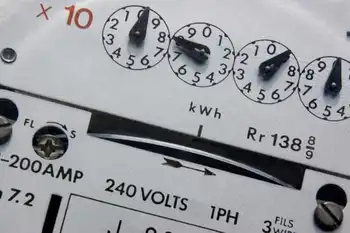

Its modest 1,200-square-foot ranch homes are gradually being torn down and replaced with 4,000-square-foot, multimillion-dollar behemoths that consume triple the kilowatts. With boulevards flanked by postcard-worthy palms and majestic Gumbo Limbo trees, it is among the wealthiest neighborhoods in one of Florida's fastest-growing economies, helping to drive profits and enhance the favorable Wall Street image of the utility's parent company, FPL Group Inc.

But when Hurricane Wilma - a medium-sized Category 1 storm - sent aging utility poles and power substations tumbling with frightening efficiency in October 2005, a darkened Rio Vista also came to symbolize the public fury that surrounded FPL. And it came just as executives were sitting down to negotiate their $11 billion takeover of Constellation.

Historically praised in the industry for being a smartly managed utility, FPL found itself accused of skimping on maintenance before last year's hurricanes.

The result, some argue, was power outages that left three-quarters of its 4.3 million customers without lights after Wilma.

That performance has left the Florida utility with what it calls a perception problem, even though executives and many of its critics say they were merely the victims of nature's wrath. It also comes as FPL is working to become the parent company to Maryland's largest utility in a deal that still faces regulatory hurdles. Executives are sorting out a recent Maryland Appeals Court decision that appears to block current state regulators from ruling on the merger.

So while residents and politicians in Maryland have fought bitterly over utility rates, the makeup of the state's utility commission and the size of Constellation Chief Executive Officer Mayo A. Shattuck III's paycheck, residents in South Florida have remained focused on one thing: keeping the lights on during the next hurricane.

"I think the perception of FPL in Florida is that they do a good job, but they extract a very handsome price for doing it," said Harold McLean, Florida's public counsel, which represents utility customers before the state's Public Service Commission. "It's a well-run company that Florida citizens love to hate."

Fort Lauderdale was among the hardest hit after Wilma and went almost completely dark, giving Rio Vista residents - including the city's outspoken six-term mayor - a rare glimpse at the stars over South Florida.

"My opinion after Wilma is that the officials at Florida Power and Light don't possess the business acumen to run a reliable power grid," said Mayor Jim Naugle, who wants the city to take over the power grid from FPL when its franchise agreement expires in 2009.

Many consumer advocates and industry officials doubt the utility deserves such rhetoric considering its power grid was pounded by an unprecedented seven hurricanes in less than two years.

Before the storms, FPL scored among the best in reliability measures and enjoyed high customer satisfaction ratings in J.D. Power and Associates surveys. FPL officials say those metrics challenge the notion that the utility has been cutting corners, or that management would seek to do the same at Baltimore Gas and Electric if the merger closes.

"The hurricanes certainly have affected our customers' perception of our company," said Armando Olivera, president of Florida Power & Light, the regulated utility operated by FPL Group. "I think some of these hurricanes hit areas that hadn't been hit by a hurricane for a number of years and, frankly, people had forgotten... the implications."

Sitting in his wood-paneled office at FPL's bucolic Juno Beach headquarters, Olivera was unapologetic for the utility's maintenance standards before Wilma, saying the company had already built its system to a standard higher than the U.S. average. It has since filed a plan with regulators to upgrade its entire system to withstand a Category 5 storm, which he says would be a first for any utility.

"That's been our policy for a very long time," he said of the company's standards. "If you look at the performance of our system in non-hurricane conditions, we have one of the best reliability (records) measured in terms of average number of minutes a customer is without power in the U.S. - about half the U.S. average. So you can't have that level of reliability if you have a crummy system that is not well-maintained and falling apart."

FPL says its customers experienced an average of 71 minutes without power last year, based on a standard industry measure that excludes outages caused by hurricanes and tropical storms. By comparison, BGE's was 241 minutes, though the utility points out that various utilities calculate the number differently. BGE also recently upgraded its reporting system, which boosted its recorded outages because of more accurate tracking.

FPL has for years been regarded as an innovator in the industry, even as it has struggled at times to balance cutting costs with keeping customers happy. With 2005 net income of $885 million, it enjoys a higher regulated profit margin than many of its Florida competitors. Yet it has not asked Florida's Public Service Commission for an increase in its base rates in more than 20 years.

In recent years, it has resolved rate cases with the commission and consumer groups through negotiations outside the hearing room - on several occasions settling for a smaller profit in the process.

The company responded to complaints that its profits were too high by agreeing to a 6 percent cut in its base rates in 1999, and another cut of 7 percent in 2002. It agreed to a four-year rate freeze in 11th-hour negotiations in 2005. The utility points out that its base rates per thousand kilowatt hour have declined by almost a fifth since 1985. Base rates don't include fuel costs, which are passed through to consumers and have increased significantly in recent years.

One reason for the company's success is Florida's rapid growth. The utility adds about 100,000 customers a year, making it one of the fastest-growing investor-owned utilities in the nation. At the same time, the average Florida household increases its power consumption about 2 percent to 5 percent annually, requiring the company to build the equivalent of about one new power plant a year just to keep pace.

But it's the unregulated side of the business - which accounts for about a fourth of the company's earnings - that is driving FPL's merger with Constellation. FPL Energy was launched in 1998 and has since grown from almost nothing into a wholesale and retail power marketer with plants and operations in 26 states.

Like Constellation, which earned $430 million in net income from its merchant energy group last year, FPL Energy buys and sells electricity to retail and business customers in competitive markets nationwide. The unit recorded a 71 percent increase in year-over-year adjusted earnings in 2005 to $299 million. It is on pace to hit $400 million this year, says Lewis Hay III, FPL's chairman and chief executive.

What most sets FPL Energy apart from Constellation and others in the generating business is its $4 billion in capital invested in wind energy, making it by far the largest U.S. wind generator with 35 percent of the market.

Michael O'Sullivan, FPL Energy's senior vice president, said the company expects to have $5 billion invested in wind projects by this time next year, with future years showing similar growth. Wind will account for about 35 percent to 37 percent of FPL Energy's earnings this year, he said.

Over the years, consumer advocates have alternatively praised and criticized the utility side of the business for its cost-cutting prowess and customer service. In the 1980s, the company formed a holding company, FPL Group, and branched into insurance, citrus groves, cable TV and other businesses in hopes of offsetting an expected move to open Florida's power market to competition.

At the same time, it embarked on a quest to win the Deming Prize - a prestigious management award given annually by a group of Japanese engineers and scientists. The effort led to quality improvements that sharply reduced power outages and customer complaints. FPL eventually became the first non-Japanese company to win the prize in 1989.

But the company's diversification strategy was deemed a failure by the late 1980s, and its new CEO, former phone executive James L. Broadhead, was required to cut costs. Upward of 4,000 of the utility's nearly 14,000 workers were cut in the early 1990s. At the end of 2005, the utility employed 10,200 and served 4.3 million customers - nearly 1.7 million more than in 1985.

The cuts took a toll in the late-1990s, when the company's quality ratings dropped significantly, forcing management to make changes to improve its service performance.

Those improvements were put to the test when the hurricanes hit, leading to an intense debate over whether the company was putting profits ahead of service. Regulators and company officials quickly fielded experts to determine whether FPL had failed to adequately replace old utility poles and keep trees trimmed ahead of the storms.

"I would say, without passing judgment, that they could have done better," said Isilio Arriaga, a commissioner with the Florida PSC.

The PSC determined that FPL - along with other utilities in Florida - was not inspecting poles as regularly as it should and directed that a new program for inspections be put in place. The commission also is proposing changes to tree trimming programs, Arriaga said. FPL says its efforts to harden its system are a work in progress, with company officials expecting it to take as much as 10 years and hundreds of millions of dollars to complete.

Driving his white Jeep Cherokee through Rio Vista recently, Naugle pointed out old, cracked wooden poles that appeared to be leaning. Others have been braced by two smaller wooden poles. But also scattered throughout the neighborhood are gleaming white concrete utility poles that look to be almost new - an example of FPL's infrastructure improvements.

Naugle and some Fort Lauderdale residents want to fire FPL and have the city take over the grid. Among them is Mitchell J. Mart, a downtown resident who lost power during Wilma. "After the service we had last year from them, we were not very happy," he said. "I didn't have electricity for 19 days. We counted them."

The devastation has played into the hands of merger opponents in Maryland, who say it bolsters their doubts about FPL's service record and raises concerns that Baltimore ratepayers could get stuck paying the tab for future hurricanes. But Florida regulators and company officials dispute those claims, pointing out that Florida Power customers pay for hurricane damage through a surcharge on their bills. Those costs will never show up on bills in Maryland, they say.

Like most residents encountered in the city, Mart has paid little attention to FPL's plans to merge with Constellation. The reasons may be economic, since Florida utility customers stand to gain little if the deal is completed. By contrast, Constellation and FPL have pledged to provide as much as $600 million in rate-relief to BGE customers if the deal goes through.

"It's not on people's minds much," said Mike Twomey, a former Florida PSC lawyer and founder of consumer watchdog Florida Utility Watch Inc. He says FPL enjoys a good reputation in the state, but he wants the merger to be closely monitored.

"The political community is not worried, either, and I've been trying to stir trouble up on this."

Related News

Alberta Advances Electricity Plans with Rate of Last Resort

ALBERTA - The Alberta government has announced significant strides in its electricity market reforms, unveiling a new plan that aims to enhance energy reliability and affordability for consumers. This initiative, highlighted by the introduction of a "rate of last resort," is a critical response to ongoing challenges in the province's electricity sector, particularly following recent market volatility and increasing consumer concerns about rising energy costs.

Understanding the Rate of Last Resort

The "rate of last resort" (RLR) is designed to ensure that all Albertans have access to affordable electricity, even when they face challenges securing a competitive rate in the…