Megawatt Penalty for Rocket Attack

By Jerusalem Post

Arc Flash Training CSA Z462 - Electrical Safety Essentials

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

The panel was set up by Defense Minister Ehud Barak and includes representatives of the IDF, the Civil Administration of Judea and Samaria and the Shin Bet (Israel Security Agency). It has submitted several recommendations for punitive measures that can quickly be implemented following a Kassam attack.

According to a senior defense official, legal experts have said they would not be able to defend punitive steps following attacks that cause no casualties or damage.

"It will need to be a rocket that hits a home or a barrage of rockets in which people are wounded or killed," the official said.

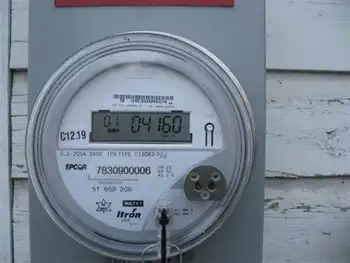

The committee has made several key recommendations, including stopping the supply of mazut - a special diesel fuel for power plants - and cutting off seven-megawatt power lines into Gaza.

In addition, after every mortar or Kassam attack on a Gaza crossing, the defense establishment has decided to automatically close it for 48 hours.

All of the crossings into Gaza were closed on September 25.

"We looked for things that would disrupt life but would be mild enough that they could be defended according to international law," the defense official said. "This is all about finding the right balance."

Some defense officials said cuts to electricity would not be enough to stop the Kassam attacks. The only real way to pressure Hamas, they said, was to completely cut off supplies to Gaza and allow a humanitarian crisis to develop.

"This is not something that we are going to do," one official said. "But it is really the only way."

Rather than stop supplying utilities, goods and services to Gaza, EU Ambassador Ramiro Cibrian-Uzal said the EU wanted to see the crossing points open not only for the passage of goods for humanitarian needs, but also for commercial purposes.

At a press briefing, he reiterated the EU's opposition to a cabinet decision to designate Gaza hostile territory, saying the conditions facing the population in the Strip were difficult enough, and it would "do no good" to make them worse.

Cibrian-Uzal said the EU had publicly articulated its concern about the policy. Israeli officials, he said, viewed last week's decision as an "enabling" one that paved the way for cutting off utilities, but not something that would be implemented immediately.

The EU ambassador said he understood that the decision was meant as a "warning" aimed at "improving the behavior of people doing nasty things." The EU was continuing to appeal for a distinction to be made between Gaza's civilian population and Hamas, he said.

Mario Mariani, the head of the EU's Temporary International Mechanism, which, in addition to bypassing Hamas in the funneling of funds to the Palestinian Authority, also supplies fuel deliveries to the Gaza power plant, said it was not clear how the decision to declare the Strip hostile territory - and the possibility that Israel would cut off utility supplies - would impact on these deliveries, which go through the Nahal Oz depot.

He said the EU provided fuel via Israel to generate 50 megawatt-hours (MWh) in Gaza, with Egypt 17 MWh of electricity and Israel providing 120 MWh.

Around 62.5 percent of Gaza's electricity is provided directly by Israel, 28.6% comes from Gaza's power plant and 8.8% comes from Egypt, according to Stuart Shepherd of the UN's Office for the Coordination of Humanitarian Affairs.

Were Israel to cut off its share, Mariani said, the EU - if it were still able to deliver the fuel through Nahal Oz - could only provide fuel for another 10 MWh, because Gaza's sole power plant cannot generate more than that.