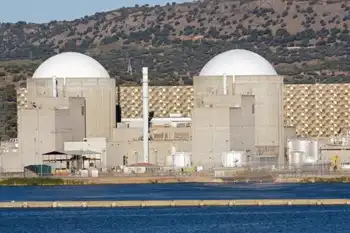

Gulf coal plant receives approval

By Associated Press

NFPA 70e Training - Arc Flash

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

While the decision by the three commissioners of the Texas Commission on Environmental Quality does allow construction of the White Stallion Energy Center to begin, the planners will have to make changes to lower projected emissions of certain toxins, including particulate matters — or soot — and sulfuric acid. In addition, the facility will not be able to begin production until it receives operating and wastewater permits.

The facility is to be built in Bay City in Matagorda County — about 75 miles south of downtown Houston. There is concern the coal-fired plant will increase smog and pollution in an area already on a federal list of cities that don't meet current ozone standards. Not only will the plant burn coal and petroleum coke — a refinery byproduct — it will bring more trucks and other vehicles into the area.

Supporters of the 1,200 net megawatt electric generation plant say it will bring much-needed jobs to the area and help address the area's future energy needs. The company's website says the plant will employ about 200 people and hire more than 2,000 during construction.

The administrative judges, who review such permit applications and make recommendations to commissioners, found several problems with White Stallion's plans, saying the company had not taken coal ash into account, despite evidence the plant would exceed permitted levels of the pollutant, the judges wrote.

"The administrative law judges cannot recommend that WSEC's White Stallion Energy Center application be granted at this time," the judges wrote in July.

Richard Hyde, TCEQ's deputy director of permitting and registration, said the company already has addressed some of the judge's concerns. As for the coal ash, Hyde said the commission felt the testimony already provided by White Stallion was adequate and there was no problem with the projections.

"We had evaluated the information and our own toxicologists said it was acceptable," Hyde said. "We felt it protects public health."

In addition, Hyde said evaluations and studies showed the facility would not harm Houston's efforts to clean up its air.

The commissioners recently declined a permit application for a similar facility proposed for Corpus Christi, asking for more technical review before construction can begin.

Jennifer Powis, a regional representative for Sierra Club, accused the commissioners of ignoring most problems raised by the judges.

"The war is not over," Powis said, vowing a fierce battle over the wastewater permit the facility will need to operate. "The citizens of Matagorda County will continue their opposition to this plant."