What can we expect from clean hydrogen in Canada

Substation Relay Protection Training

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

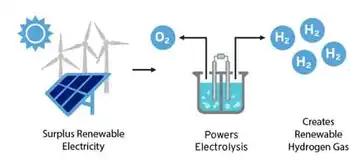

Canadian Clean Hydrogen is surging, driven by net-zero goals, tax credits, and exports. Fuel cells, electrolysis, and low-emissions power and transport signal growth, though current production is largely fossil-based and needs decarbonization.

Key Points

Canadian Clean Hydrogen is the shift to make and use low-emissions hydrogen for energy and industry to reach net-zero.

✅ $17B tax credits through 2035 to scale electrolyzers and hubs

✅ Export MOUs with Germany and the Netherlands target 2025 shipments

✅ IEA: 99% of hydrogen from fossil fuels; deep decarbonization needed

As the world races to find effective climate solutions, and toward an electric planet vision, hydrogen is earning buzz as a potentially low-emitting alternative fuel source.

The promise of hydrogen as a clean fuel source is nothing new — as far back as the 1970s hydrogen was being promised as a "potential pollution-free fuel for our cars."

While hydrogen hasn't yet taken off as the fuel of the future — a 2023 report from McKinsey & Company and the Hydrogen Council estimates that there is a grand total of eight hydrogen vehicle fuelling stations in Canada — many still hope that will change.

The hope is hydrogen will play a significant role in combating climate change, serving as a low-emissions substitute for fossil fuels in power generation, home heating and transportation, where cleaning up electricity remains critical, and today, interest in a Canadian clean hydrogen industry may be starting to bubble over.

"People are super excited about hydrogen because of the opportunity to use it as a clean chemical fuel. So, as a displacement for natural gas, diesel, gasoline, jet fuel," said Andrew Gillis, CEO of Canadian hydrogen company Aurora Hydrogen.

Plans for low or zero-emissions hydrogen projects are beginning to take shape across the country. But, at the moment, hydrogen is far from a low-emissions fuel, which is why some experts suggest expectations for the resource should be tempered.

The IEA report indicates that in 2021, global hydrogen production emitted 900 million tonnes of carbon dioxide — roughly 180 million more than the aviation industry — as roughly 99 per cent of hydrogen production came from fossil fuel sources.

"There is a concern that the role of hydrogen in the process of decarbonization is being very greatly overstated," said Mark Winfield, professor of environmental and urban change at York University.

A growing excitement

In 2020, the government released a hydrogen strategy, aiming to "cement hydrogen as a tool to achieve our goal of net-zero emissions by 2050 and position Canada as a global, industrial leader of clean renewable fuels."

The latest budget includes over $17 billion in tax credits between now and 2035 to help fund clean hydrogen projects.

Today, the most common application for hydrogen in Canada is as a material in industrial activities such as oil refining and ammonia, methanol and steel production, according to Natural Resources Canada.

But, the buzz around hydrogen isn't exactly over its industrial applications, said Aurora Hydrogen's Gillis.

"All these sorts of things where we currently have emitting gaseous or liquid chemical fuels, hydrogen's an opportunity to replace those and access the energy without creating emissions at the point of us," Gillis said.

When used in a fuel cell, hydrogen can produce electricity for transportation, heating and power generation without producing common harmful emissions like nitrogen oxide, hydrocarbons and particulate matter — BloombergNEF estimates that hydrogen could meet 24 per cent of global energy demand by 2050.

A growing industry

Canada's hydrogen strategy aims to have 30 per cent of end-use energy be from clean hydrogen by 2050. According to the strategy, Canada produces an estimated three million tonnes of hydrogen per year from natural gas today, but the strategy doesn't indicate how much hydrogen is produced from low-emissions sources.

In recent years, the Canadian clean hydrogen industry has earned international interest, especially as Germany's hydrogen strategy anticipates significant imports.

In 2021, Canada signed a memorandum of understanding with the Netherlands to help develop "export-import corridors for clean hydrogen" between the two countries. Canada also recently inked a deal with Germany to start exporting the resource there by 2025.

But while a low-emissions hydrogen plant went online in Becancour, Que., in 2021, the rest of Canada's clean-hydrogen industry seems to be in the early stages.