Dismiss remaining charges, asks former Westar CEO, strategy officer

The defense attorneys for former Chief Executive David Wittig and former chief strategy officer Douglas Lake argued before U.S. District Judge Julie Robinson that an appellate court ruling last year effectively prohibited prosecutors from using evidence necessary to charge the two men.

They also said other charges aren't supported by securities laws dealing with public companies.

Wittig and Lake were convicted in 2005 of wire fraud, money laundering, conspiracy and circumvention of internal controls. The charges were tied to a scheme prosecutors claimed was designed to increase the men's compensation at the Topeka-based utility and hide it from regulators and shareholders.

The 10th U.S. Circuit Court of Appeals threw out the convictions in January 2007 and barred prosecutors from retrying Wittig and Lake on the fraud and money laundering charges, saying they hadn't presented enough evidence that the men's actions were criminal.

The two are scheduled to be tried on the remaining conspiracy and circumvention charges on September 9.

Lake attorney Patrick McInerney said that by banning any reference to the fraud and money laundering charges, the appellate court also barred prosecutors from resubmitting much of the evidence that is necessary to prove the two men were part of a conspiracy. To do so, he said, would violate the defendants' constitutional protection against double jeopardy.

Assistant U.S. Attorney Richard Hathaway said it was possible to convict someone of conspiracy even if the defendant isn't convicted of the underlying illegal acts.

The defense attorneys also argued that the two men shouldn't be retried on the circumvention of internal controls, which claim Wittig and Lake intentionally underreported how often they used corporate aircraft for personal trips — which officials consider part of an executive's compensation.

They said that circumvention charges must involve a company's financial documents and that the Securities and Exchange Commission doesn't consider executive pay and benefits are financial.

Robinson, who didn't immediately rule on the motion to dismiss the remaining charges, said she doubted the appellate court would have bothered remanding the case back to district court if no other charges were possible.

"In reading the 10th Circuit's opinion, there's strong language that they meant what they said and they meant for there to be a retrial," she said.

Related News

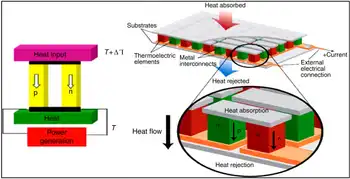

A new approach finds materials that can turn waste heat into electricity

LONDON - The need to transition to clean energy is apparent, urgent and inescapable. We must limit Earth’s rising temperature to within 1.5 C to avoid the worst effects of climate change — an especially daunting challenge in the face of the steadily increasing global demand for energy.

Part of the answer is using energy more efficiently. More than 72 per cent of all energy produced worldwide is lost in the form of heat. For example, the engine in a car uses only about 30 per cent of the gasoline it burns to move the car. The remainder is dissipated as…