BC Hydro expects rush for clean energy projects

By National Post

Electrical Testing & Commissioning of Power Systems

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

Early pioneers flocked to B.C.'s Caribou and northern regions in the in search of gold, while today a new breed of explorer is fanning out across the province seeking a motherlode that can bring new, clean power to the province.

Experts suggest as many as 200 proposals could result from a call for clean energy projects issued last June by B.C. Hydro, the province's Crown-owned power utility.

Energy proponents have until Nov. 25 to register their plans with the utility. The Crown corporation will announce its choices in June 2009.

B.C. Hydro said it made 5,000 gigawatts of power available for the clean energy projects, enough energy to power 500,000 homes.

Hydro uses up to 54,000 gigawatts annually, but has its sights set on getting 90 per cent of its power from clean and renewable sources and being energy self-sufficient by 2016.

It's exciting times for would-be power producers as they explore the province looking for the right locations to generate clean energy and profits, says Steve Davis, president of the Independent Power Producers Association of B.C.

"They're all out looking for renewable clean power and a way to lasso it," he said.

Wind power, where energy-generating turbines are kept spinning by steady breezes, and run-of-the-river, where constantly flowing water keeps turbines moving, are expected to make up the majority of the clean-power proposals.

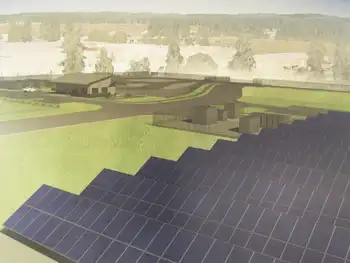

Some solar proposals are also expected.

NaiKun Wind Energy Group is interested in a wind-energy project in B.C.'s Hecate Strait near the Queen Charlotte Islands.

Finavera Renewables is researching wind power in B.C.'s Peace River region near Chetwynd and Plutonic Power Corp., is planning a run-of- the-river project on B.C.'s southwest coast near Toba and Bute Inlets.

Davis said developing clean energy projects requires huge investments in time and money.

Wind projects are especially expensive and time-consuming because investors need to see data proving there is enough constant wind to generate power, he said.

"You go where the sweetest wind is," said Davis. "You only get paid when the wind is blowing."

He said wind-power explorers study the landscape for tell-tale signs that an area is constantly breezy. When they see trees that have their sides shaved off, it's a good bet the wind is always blowing, Davis said.

He said he expects B.C. Hydro will receive between 80 and 100 proposals to its clean power call.

British Columbia hasn't built a major energy project since the mid when it completed the Revelstoke dam.

Energy expert David Austin said the clean power call has the potential to do more than just provide clean, renewable energy. It can also help control rising energy costs.

"It's exciting that people are interested, because the more people who are interested, the lower the prices are going to be because the greater the competition will be," he said.

Austin said the clean power projects will require federal and provincial environmental approval and also go through an approval process by British Columbia's Utility Commission.

"We may have a starting gate that has 200 horses in it," he said. "I expect there's going to be a lot of bidders in this clean power call, but still, the B.C. Utilities Commission has to decide the demand and confirm B.C. Hydro's need and it also has to confirm all contracts B.C. Hydro has to enter into."

Austin agreed that British Columbia's rugged, remote and vast landscape provides energy entrepreneurs with numerous opportunities to develop clean energy.

"You've got the potential for wind projects in this province," he said. "You've got the potential for run of river hydro projects in this province. Maybe someone's come in on the tidal side or there is the ocean side, I don't know, because right now it's so early it's hard to tell how big the starting gate is for the horse race."

Hydro spokesman Dag Sharman said he wouldn't discuss individual proposals, but acknowledged that British Columbians want clean energy.

The B.C. government has embarked on a clean energy initiative to cut greenhouse gases by one third by 2020.

"All new electricity-generating projects are going have to have zero net greenhouse gas emissions," said Sharman. "The reason for these calls is we're committed to be electricity self-sufficient by 2016."

While private energy companies search for potential production sites and deep pockets to fund the projects, British Columbians will themselves be forced to consider the value of new ways of providing energy, said Guy Dauncey, B.C. Sustainable Energy Association spokesman.

"The dilemma with this field is there is a lot of hyperbole and a lot of dramatic positioning driven sometimes by very real ecological concerns, sometimes by other factors," he said.

Dauncey said the power issue in British Columbia has always been locked in an environmental debate between builders and preservationists.

The goal is finding the balance between meeting energy needs and doing as little harm to the environment as possible, he said.

There's also the constant debate between those who support public power and those who favour a combination of public and private energy services, said Dauncey.

"Every (builder) has to pound the ground and cut the forest down to put a house in its place," he said.

"Every media news studio has to have foundations dug for it. If you accept that we need electricity, you then have to say which is the footprint that is desirable or less desirable."