EDF battles to keep its nuclear secrets

By International Herald Tribune

Protective Relay Training - Basic

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

Less than three years after fending off spying charges from EDF's German affiliate, Kunze's company, Powermonitor, plans to sell information about reactor starts and stops in France. Banks, hedge funds and traders will pay for the data to gain an edge in continental Europe's $565 billion power market.

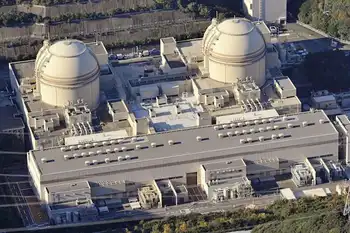

EDF is at the center of a battle over the disclosure of such data, which Citigroup says may save European electricity users billions of euros a year. The state-owned utility refuses to release information on plant operations that its biggest competitors, E.ON and RWE, began reporting last year. Now the European Union may force the company to be more transparent.

"Generation is the most valuable piece of information there is and we want this in real-time or near real-time," said Paul Dawson, head of regulatory affairs at Citigroup, which began trading European power last year.

Such data is important because prices hinge on the amount of power being produced at any time, given that electricity, unlike other commodities, cannot be stored. National markets are linked, so unexpected supply cuts in France tend to mean that prices soar in neighboring markets. Those with information about outages can anticipate the jump.

Increased transparency could bring "substantial savings" for consumers by increasing competition in wholesale markets, said Peter Styles, chairman of the electricity committee at the European Federation of Energy Traders.

"The primary obligation should fall on generators themselves" to publish more information, he said.

In December 2005, EDF's German affiliate, Energie Baden-Württemberg, went to court, claiming Kunze was engaged in industrial espionage by monitoring output from the Neckarwestheim nuclear plant in southwest Germany. The Heilbronn district court ruled for Kunze.

EDF, the largest power generator, does not release information from individual plants because it is "commercially sensitive," said Carole Trivi, a utility spokeswoman. The company does provide national aggregate data daily by fuel type. Trivi declined to comment on Citigroup's cost estimate.

EnBW has no plans to publish data broken down by plant unless it's part of a Europewide program, said Friederike Eggstein, a spokeswoman for the utility, based in Karlsruhe.

The European Parliament approved new laws June 18 designed to create a network of European transmission-system operators. Its task will be to improve the electricity markets, partly by requiring the release of more generation data. National governments still have to endorse the proposals.

A merger between European Energy Exchange and Powernext, the power exchanges in Germany and France, may also eventually force EDF to report the same data as E.ON and RWE.

"As long as France keeps playing this game, the market isn't functioning properly and in the end it's hitting the consumers" because trading is less efficient, said Fredrik Bodecker, managing director of hedge fund company Nordic Commodity Funds in Stockholm. The company runs a Nordic electricity fund and may start one for continental power, fuels and carbon permits as early as October.

The lack of operational data also affects safety by making it difficult to advise the public about when nuclear fuel will be shipped to and from the plants, said Frederic Marillier, a nuclear campaigner for Greenpeace France.

Trivi at EDF, based in Paris, declined to comment on that charge.

"It's really a big problem that even basic information isn't available," Marillier said.

The Nordic region and Britain are the only Western Europe markets that require power companies to report availability and output in near real-time.

Nordic utilities have to disclose halts as much as three years ahead. Spain's Atomic Energy Regulator publishes operational updates for the country's reactors on its Web site.

In the absence of broader disclosure, traders have turned to Powermonitor and a larger rival, Genscape, which is currently the only provider of real-time information on EDF's 58 reactors. Powermonitor plans to start its French service in September, Kunze said.

Such data comes at a cost. Genscape, which monitors plants in seven European countries and the United States, charges as much as 900,000 euros, or $1.4 million, a year for its service, according to traders who declined to be identified because the price is confidential.

Christian Essers, a Genscape managing director in Amsterdam, declined to comment on pricing.

The value of individual power plant data across the EU "could easily run into billions of euros every year," for consumers, said Dawson at Citigroup.

"This isn't about finding out private information about the companies," he said. "It's about getting a picture of the whole power system."