Intalco will struggle with new power deal: BPA to subsidize portion of smelter's 'hugely' bigger bill

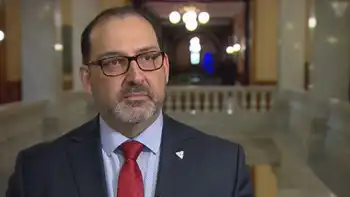

Mike Rousseau, general manager of the big aluminum smelter west of Ferndale, said the new five-year contract with the Bonneville Power Administration means Intalco will be paying "hugely more" for the power it needs.

The exact amount depends on what kind of alternative power sources the company can find.

But he and his 440 employees are going to continue the struggle to keep the plant operating.

"We're being dealt a very difficult hand," Rousseau said. "The employees and the union and the state have stepped up to help us deal with the hand we've been dealt.... We're going to do what we can to make this thing work."

The employees and their union, the International Association of Machinists and Aerospace Workers Local 2379, have agreed to a contract extension that keeps their hourly pay at about $20, Rousseau said. In the last legislative session, lawmakers agreed to a package of tax breaks designed to help keep the smelter in business and its workers employed.

The key terms of the power deal finalized recently are about the same as the proposal that BPA first floated nearly a year ago, in which BPA would provide Alcoa and two other Northwest aluminum firms with a cash subsidy, rather than an actual supply of low-cost hydropower. Alcoa will purchase its power in the marketplace, and BPA will pay the company to compensate it for some portion of the difference between its market power costs and the lower-cost BPA hydropower.

The payment will generally be $12 per megawatt and will cover no more than 320 megawatts of Alcoa's power purchases. BPA would spend no more than $59 million in total subsidies to Alcoa and the other two firms. And the deal also prohibits the aluminum companies from getting an effective power rate below the current lowest BPA rate of about $30 per megawatt with the subsidy included.

Alcoa had tried to convince BPA to supply it with 625 megawatts - the amount the firm would need to run both its Intalco and Wenatchee smelters at capacity.

But 625 megawatts is roughly enough to supply half of Seattle, and many of BPA's other customers argued strenuously against continuing to provide the aluminum companies with any kind of power supply or subsidy.

The Northwest aluminum industry became established decades ago after the completion of Columbia River dams that gave the region far more power than it could use. BPA marketed the surplus to the power- intensive aluminum industry at rock-bottom rates.

The region's steady growth gradually used up the surplus. The public utility systems that have first legal claim on BPA hydropower can buy up all that is available and then some. As the region's power supply tightened and prices rose, most area aluminum smelters closed up shop, leaving Intalco among a small group of struggling survivors. At its peak, Intalco employed more than 1,000 workers.

Mike Hansen, a BPA spokesman, said his agency has no legal obligations to provide Alcoa or other aluminum firms with cheap power or with a cash subsidy. But BPA offered the $12-per-megawatt subsidy to help them survive.

"The aluminum companies have been longtime customers of BPA and good business partners for the Northwest," Hansen said.

Intalco's Rousseau said the smelter's survival is far from certain. There is no assurance that Alcoa can find a power supply that will be low enough to make aluminum production profitable, even with the $12 subsidy.

"With the increases in power (cost) that BPA's putting to us, it has put this facility at an unfair risk," Rousseau said.

Vicki Henley, the chief shop steward for Local 2379, said the years of struggle have been tough on the workers.

"We've lost a lot of good people because of the uncertainty," Henley said. "We're doing what we can to keep this place open."

Both Henley and Rousseau expressed hope that if Intalco can survive the next five-year power contract, something better could be arranged for the next contract period that would put the smelter and its jobs on firmer footing.

World demand for aluminum is strong, and smelters can prosper if they get the power price they need.

"We're not a dying industry," Henley said. "They're killing us."

Related News

Coronavirus puts electric carmakers on alert over lithium supplies

BEIJING - The global outbreak of coronavirus will accelerate efforts by western carmakers to localise supplies of lithium for electric car batteries, according to US producer Livent.

The industry was keen to diversify away from China, which produces the bulk of the world’s lithium, a critical material for lithium-ion batteries, said Paul Graves, Livent’s chief executive.

“It’s a conversation that’s starting to happen that was not happening even six months ago,” especially in the US, the former Goldman Sachs banker added.

China produced about 79 per cent of the lithium hydroxide used in electric car batteries last year, according to consultancy CRU, a…